Renowned crypto investor Arthur Hayes has delivered a sharp critique of Monad, arguing that the recently launched layer-1 blockchain carries an extreme collapse risk. According to Hayes, the project’s token structure exposes retail participants to severe downside and could potentially result in losses as high as 99%.

High FDV and Low Circulating Supply: A Hazardous Combination

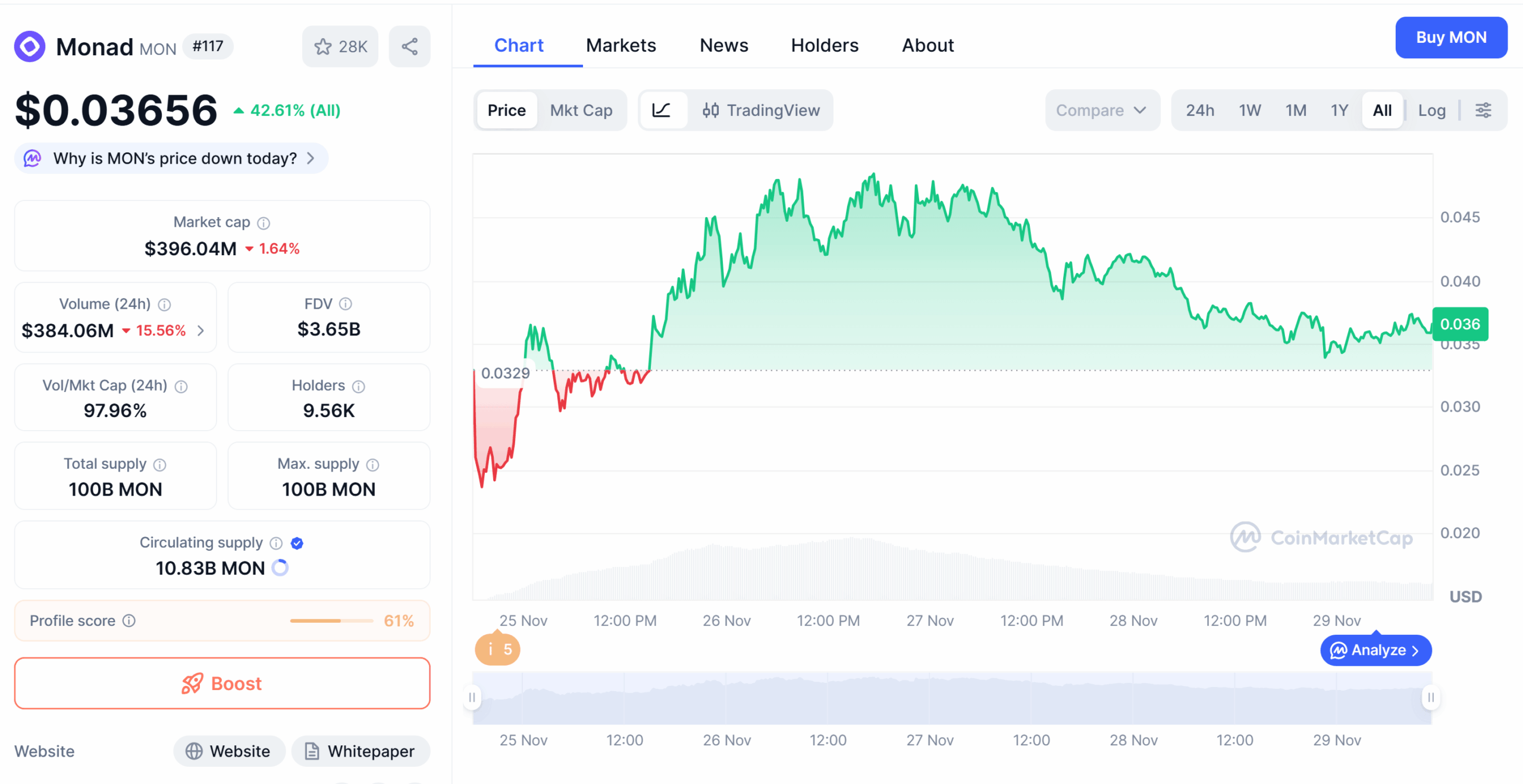

Speaking on Altcoin Daily, the former BitMEX CEO described Monad as a classic example of a “high FDV, low-float VC token.” Fully Diluted Value (FDV) represents the valuation of a project if all tokens were already released. Hayes emphasized that when there is a significant gap between FDV and the available circulating supply, the imbalance often creates dangerous market dynamics.

He noted that such projects typically see an early price surge, only to experience aggressive selloffs once insider or investor allocations begin unlocking. In his view, Monad fits this pattern: a token that might enjoy an initial rally but lacks evidence of long-term sustainable demand. “A strong early pump does not imply lasting utility,” he cautioned.

Most Layer-1 Networks Fail to Survive

Hayes further argued that only a select few layer-1 protocols will maintain relevance over time. Historically, he said, new networks struggle to secure meaningful adoption. For the next market cycle, he believes only Bitcoin, Ethereum, Solana, and Zcash stand a realistic chance of remaining dominant.

Monad, meanwhile, raised $225 million in a funding round led by Paradigm last year and officially launched its mainnet recently, along with its native MON token.

Liquidity Expansion Could Ignite the Next Bull Market

Despite his skepticism toward Monad, Hayes maintains a broadly bullish outlook for the crypto market. He expects global liquidity to expand as the United States enters a politically charged period and economic growth softens, potentially prompting renewed monetary easing. He argued that the market is still in the early stages of this cycle, with major liquidity-driven rallies yet to unfold.

He also downplayed the traditional four-year Bitcoin cycle narrative, asserting that previous booms were shaped not by halvings but by global credit expansion led by the U.S. and China.

Privacy Technologies Set to Lead the Next Narrative

Looking forward, Hayes anticipates that privacy-focused solutions will play a central role in the next major trend. He expects zero-knowledge technologies and privacy coins to attract renewed attention, while institutions increasingly gravitate toward Ethereum for stablecoin and tokenization infrastructure. He also revealed that Zcash has become the second-largest holding in his family office, Maelstrom.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.