While the crypto market faces heavy selling pressure, Bitcoin whales have once again stepped into the spotlight. Despite BTC falling below $101,000, large investors are viewing this pullback as a strategic buying opportunity. On-chain data reveals that whales have accumulated roughly 29,600 BTC—worth about $3 billion—over the past week.

Whales Launch a Massive Accumulation Campaign

According to CryptoQuant, wallets holding between 1,000 and 10,000 BTC have significantly increased their balances over the last seven days. Analyst JA Maartun reported that holdings in this category have grown from 3.436 million BTC to 3.504 million BTC, marking the largest wave of accumulation since late September.

This pattern suggests a restoration of confidence after recent price corrections. Institutional whale accumulation typically occurs when “weak hands” sell, often signaling a potential market bottom.

Despite ETF Outflows and Panic, Whales Keep Buying

Over the past few weeks, U.S. spot Bitcoin ETFs have seen more than $660 million in net outflows, while retail traders have reduced exposure to risk assets. More than $1 billion worth of leveraged positions have been liquidated, deepening short-term selling pressure.

However, whales took advantage of this downturn, quietly buying into the weakness. Their accumulation underscores the contrast between “smart money” (institutional investors) and retail traders. Historically, this type of divergence often occurs near the final stage of market corrections.

Tightening Liquidity Strengthens the $100,000 Support

This week’s whale purchases amount to nearly four times the weekly mining supply, a development that significantly strengthens Bitcoin’s $100,000 support zone by reducing available liquidity on exchanges.

Analysts note that declining liquid supply could shift the supply-demand balance in favor of the bulls, reinforcing price stability in the medium term. Despite the Federal Reserve’s cautious stance on rate cuts, this accumulation trend shows that long-term investor confidence in crypto remains strong.

A Strategic “Buy-the-Dip” Move Despite Macro Headwinds

On the macro front, the Federal Reserve’s “wait-and-see” approach and rising bond yields have pressured risk assets. Yet whales are treating this weakness as a liquidity gap opportunity. Historically, whale accumulation during periods of volatility signals strategic long-term positioning.

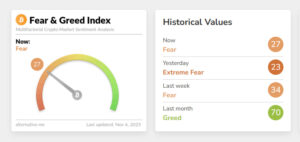

Technically, Bitcoin appears to be consolidating between $100,000 and $107,000. Meanwhile, the Fear & Greed Index has plunged into “extreme fear” territory—often seen near the start of new bullish cycles. Analysts predict that if accumulation continues, BTC could rebound toward the $115,000–$120,000 range in the coming weeks. However, short-term volatility may remain elevated, making the $100,000 support level crucial to monitor closely.

Conclusion

Whales’ recent $3 billion accumulation marks a renewed vote of confidence in Bitcoin’s long-term outlook. Despite ETF outflows and short-term panic selling, major investors are treating this period as a strategic accumulation window.

Historically, such accumulation phases have preceded major uptrends. As long as Bitcoin holds above the $100,000 support zone, analysts believe the broader bullish structure remains intact, setting the stage for the next leg higher in the medium term.