Aster (ASTER) has begun to show early signs of recovery despite a challenging week for the broader crypto market. Supported by the project’s aggressive buyback program and the positive sentiment generated by its Coinbase listing, the token appears to be entering an early reversal phase even as short-term price action remains volatile.

Short-Term Outlook for Aster

At the time of writing, Aster is trading at $1.16. Although the 4.2% drop in the past 24 hours has raised some concern among investors, the broader price structure still indicates a recovery trend. Over the past week, the token has fluctuated between $1.02 and $1.39, gaining 22% weekly and 19% monthly. These figures show that despite bearish market conditions, Aster has managed to build a strong support base.

Trading volume also remains notable. The 24-hour spot volume has surged to $953 million, indicating a substantial inflow of liquidity. Futures markets, however, paint a more cautious picture: while futures volume has increased, open interest has dropped suggesting traders are reassessing positions rather than taking on additional risk.

Buyback Program Reignites Market Sentiment

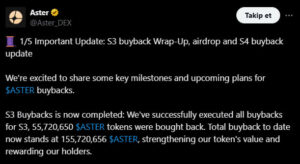

The primary driver behind Aster’s current rebound is the project team’s powerful buyback initiative. The third phase of the repurchase plan, completed on November 20, saw 55.7 million ASTER bought back bringing the total number of tokens repurchased to 155.7 million ASTER to date. At current prices, the latest round alone represents roughly $70 million worth of buybacks.

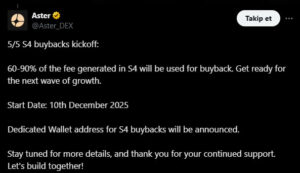

Perhaps the most impactful element is that half of these tokens (77.8 million ASTER) will be burned on December 5. This direct reduction in supply is one of the strongest mechanisms supporting mid-term price appreciation. The remaining tokens will be held for future airdrop programs, while Phase 4 of the buyback initiative is expected to begin on December 10. A significant portion of the protocol’s fee revenue is being allocated to buybacks — a long-term stabilizing force for the token.

Coinbase Listing Sparks U.S. Market Interest

Another major catalyst has been Aster’s listing on Coinbase, which not only boosted liquidity but also significantly increased the project’s global visibility. Following the listing, ASTER’s spot price jumped from $1.14 to $1.37 in a rapid surge. Although the momentum later cooled, gaining exposure to U.S.-based retail and institutional investors is expected to strengthen long-term demand.

Within just a few hours of the listing, trading volumes surpassed $1 million, showing that investor interest remained strong despite broader market uncertainty. The move also symbolizes Aster’s transition from the BNB Chain ecosystem into alignment with a major global exchange — a strategic milestone in the project’s growth.

Is a Positive Cycle Beginning for Aster?

Despite the turbulent week across the crypto sector, Aster continues to exhibit resilience thanks to its buyback program, token burn mechanism, new exchange listings, and improving technical structure. Historically, projects that make such strategic moves during market downturns tend to recover faster once conditions stabilize.

With supply-reducing mechanics and increased investor exposure working together, Aster maintains a solid foundation for mid-term bullish potential — provided broader market conditions do not deteriorate further.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.