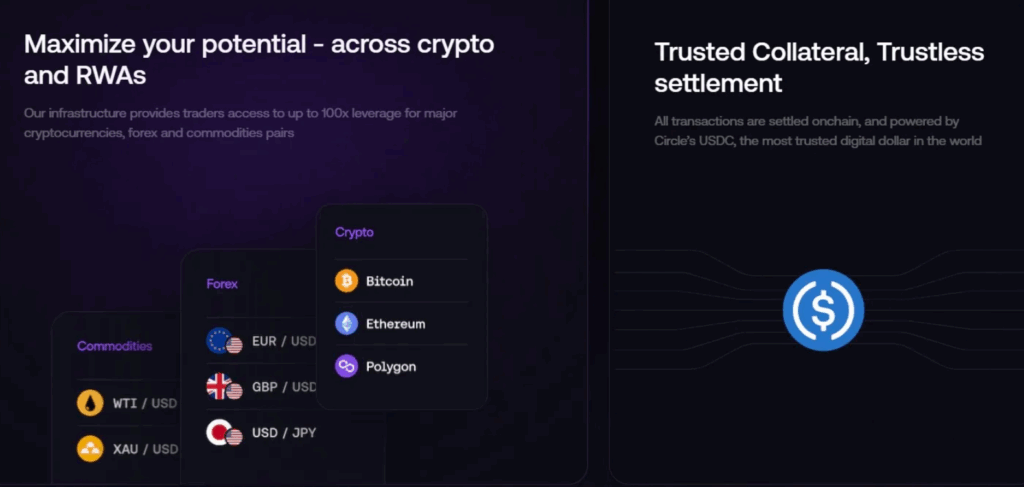

Avantis is a decentralized perpetuals exchange designed to offer high-leverage trading on crypto and real-world assets (RWA). Users can trade crypto, forex (FX), commodities, indices, and soon equities with up to 500x leverage in a transparent and permissionless environment.

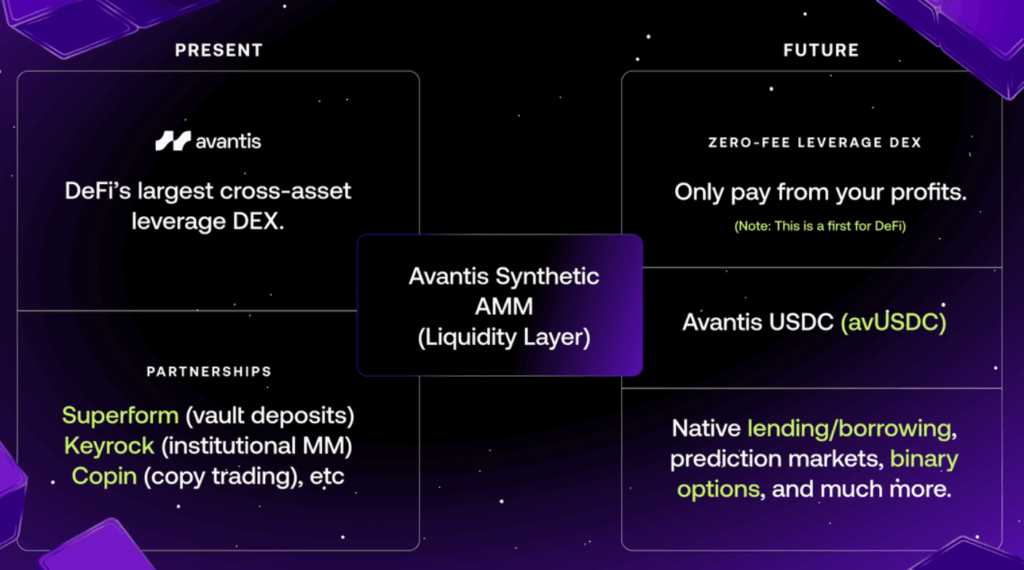

Avantis introduced a first in the DeFi world with its Zero-Fee Perpetuals (ZFP) model. In this model, users only pay trading fees when they make profits. Since its launch in February 2024, Avantis has generated over $12 billion in trading volume and 1.5 million trades.

Project Concept

Avantis aims to bring leveraged trading capabilities from traditional finance on-chain, combining crypto and RWA on a single platform. With the motto “One DEX, infinite strategies,” the project seeks to create a universal leverage layer that allows users to combine macroeconomic insights with crypto narratives.

Key features include:

- Synthetic Leverage Engine: A single USDC liquidity vault acts as the counterparty for all trades, eliminating the need for separate liquidity pools for each asset pair and maximizing capital efficiency.

- Real-World Asset Access: Users can trade not only cryptocurrencies like Bitcoin and Ethereum but also assets like Japanese Yen, gold, and US equity indices.

- Zero-Fee Leverage: Traders only pay fees on profitable trades, making it attractive for short-term and high-frequency trading.

Team and Founders

Founders:

- Harsehaj Singh (CEO): Formerly led the investment team at Pantera Capital.

- Raymond Dong (COO): Experience in finance, consulting, and crypto products with Lazard, McKinsey, and Bow Capital.

Developer Team:

- Engineers and designers from the US, India, and Europe.

- Previous experience at Binance, Quantopian, and major fintech firms.

- Over 20 years of combined crypto and finance experience.

- The protocol is managed by the Cayman-based Avantis Foundation.

Investors and Partnerships

Avantis is backed by leading investors:

- Pantera Capital

- Founders Fund

- Galaxy Digital

- Base Ecosystem Fund

- Coinbase ecosystem support

- Superform: Vault investments

- Keyrock: Institutional market-making

- Copin: Copy trading

- This support has positioned Avantis as the largest DEX on Base.

How the Protocol Works

Avantis uses a single USDC vault instead of an order book. The vault aggregates funds from liquidity providers (LPs). When a trader opens a position, the vault acts as the counterparty. This model, called Avantis Synthetic AMM (Liquidity Layer), is highly capital-efficient as it avoids separate pools for each asset.

Key features

- Synthetic Leverage: Up to 500x leverage via USDC-based liquidity pools.

- Loss Rebates: Token refunds for specific losing trades.

- Positive Slippage: Price improvements in favor of users.

- Zero-Fee Perpetuals: Fees charged only when profitable.

- Liquidity Providers: Risk/reward management through passive USDC staking or active market-making.

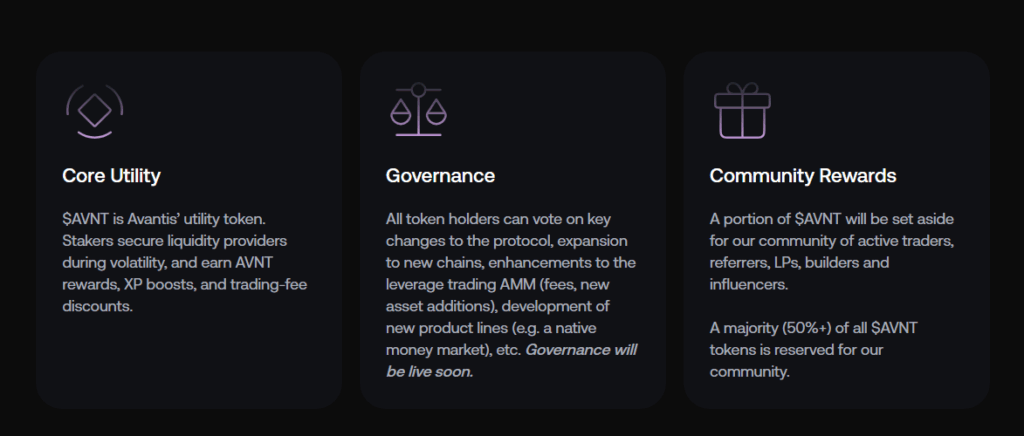

Governance

The native AVNT token plays a central role in governance. Token holders vote on:

- Protocol upgrades

- Fee policies

- Adding new products

- The protocol is governed by the Avantis Foundation.

Roadmap

- 2024 Q1–Q4: Mainnet beta, LP pools, zero-fee perpetuals development, 100x leverage, major audits.

- 2025 Q1: Avantis XP Season 2, new lending/borrowing integrations, crude oil perps listing.

- 2025 Q2: Zero-Fee Perps (BTC, ETH, SOL) launch, 500x leverage, SPY/NASDAQ indices.

2025 H2 & beyond:

- 100+ real-world assets (including equities)

- Avantis v2: dedicated L2 for RWA & crypto

- Sports and prediction market integrations

AVNT Token vs. Avantis

- Avantis: The decentralized protocol offering high-leverage trading.

- AVNT: The native token powering all protocol functionalities.

Token Use Cases (AVNT)

- Governance: Voting on protocol decisions.

- Staking & Security: Covering vault losses and earning rewards.

- Incentives: Trader, LP, and referral program rewards.

- Liquidity Provision: Used in ETH/USDC farms.

- Loss Rebates: Refunds for certain losses.

Token Info

- Token Name: Avantis

- Symbol: AVNT

- Blockchain: Ethereum, Base

- Type: Utility & Governance

- Max Supply: 1 billion AVNT

- Circulating Supply: 205 million AVNT

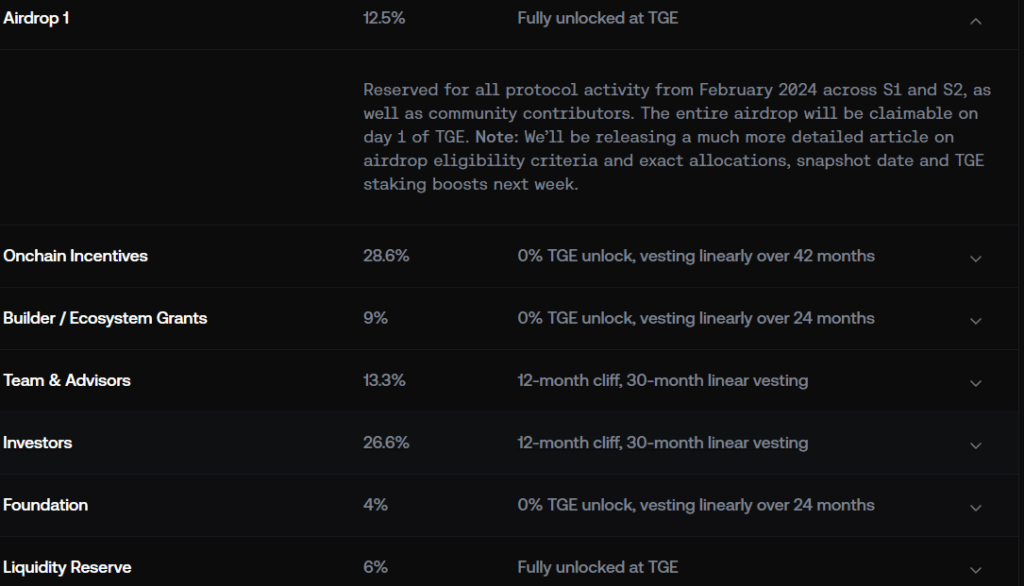

Token Distribution

- Airdrop 1 (12.5%): 100% unlocked at TGE, for 2024 Season 1–2 activities.

- On-Chain Incentives (28.6%): TGE locked, linear release over 42 months.

- Developer/Ecosystem Grants (9%): TGE locked, linear release over 24 months.

- Team & Advisors (13.3%): 12-month lock, then linear release over 30 months.

- Investors (26.6%): 12-month lock, then linear release over 30 months.

- Foundation (4%): TGE locked, linear release over 24 months.

- Liquidity Reserve (6%): 100% unlocked at TGE.

Ecosystem and Features

- 500x leveraged trading

- RWA + Crypto in a single terminal

- Zero-Fee Perps (no fee if not profitable)

- USDC-based risk and time parameters

- Custom-built risk management

- Upcoming prediction and sports market integrations

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.