As of October 23, a notable shift has been observed in investor sentiment across the crypto markets. Recent movements in the spot ETF market clearly highlight which assets investors are gravitating toward. The growing divergence between Ethereum and Bitcoin ETFs reflects new strategic preferences among institutional investors.

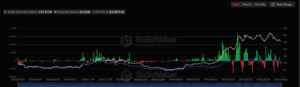

Weak Demand Signals in Ethereum ETFs

Ethereum-focused investment funds have recorded a significant capital outflow, with a net withdrawal of $127.51 million. Notably, none of the nine Ethereum ETFs reported any net inflows. This indicates a decline in short-term investor confidence toward Ethereum. Market analysts suggest that this trend could exert downward pressure on Ethereum’s price stability and trading volume. Institutional investors are reportedly shifting toward safer and more liquid assets, favoring Bitcoin as a more resilient store of value.

Some experts note that while this outflow trend may be temporary, Ethereum ETFs will need a stronger market recovery before they can regain investor appeal and attract renewed capital inflows.

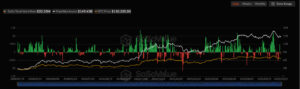

Strong Inflows into Bitcoin ETFs: BlackRock Leads the Way

While Ethereum experienced outflows, Bitcoin ETFs showed the opposite trend, recording a total net inflow of $20.33 million. BlackRock’s iShares Bitcoin Trust (IBIT) stood out as the clear leader, attracting a substantial $108 million inflow. This development highlights the growing and sustained interest of institutional investors in Bitcoin. According to experts, the steady inflows into Bitcoin ETFs indicate that investors continue to view Bitcoin as a safer and long-term store of value.

Moreover, other Bitcoin ETFs are also seeing smaller but consistent inflows, suggesting that institutional demand for Bitcoin is broadening across multiple funds reinforcing Bitcoin’s dominant position as the preferred asset in the current market cycle.

Expert Opinions: “The Market Clearly Favors Bitcoin”

Crypto analyst Sarah Mitchell shared her insights on the recent developments:

“The outflows seen in Ethereum ETFs may be due to short-term profit-taking, but the overall trend is in favor of Bitcoin. Institutional investors view Bitcoin as a more stable haven amid market uncertainty.”

Similarly, other analysts note that while Ethereum still holds medium-term recovery potential, current conditions point to a capital shift centered around Bitcoin.

Power Dynamics in Crypto ETFs Are Being Redefined

As of October 23, Ethereum ETFs have been shaken by large investor outflows, while Bitcoin ETFs continue to attract strong inflows. This clearly indicates that capital across the crypto market is pivoting back toward Bitcoin.

Experts predict that if this trend continues in the coming weeks, Bitcoin prices could gain new upward momentum. Meanwhile, on the Ethereum side, developments in DeFi and staking could lay the foundation for a potential recovery in the near future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.