The shocking decision by Donald Trump to impose a 100% tariff on Chinese goods has sent shockwaves through global markets impacting not only traditional finance but also the cryptocurrency market. The renewed trade tensions between the U.S. and China have drastically reduced investor risk appetite, triggering a global sell-off. In the crypto space, where highly leveraged positions are common, the sharp price declines led to a wave of mass liquidations.

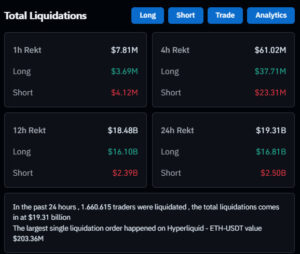

In the last 24 hours, nearly $19.3 billion worth of open positions have been wiped out, marking one of the largest liquidation events in crypto history. Analysts note that the magnitude of this move stems not only from political tensions but also from the fragile and speculative market structure that has emerged in recent weeks.

An Unprecedented Event in Crypto History

According to data from CoinGlass, a total of $19.3 billion in open positions were liquidated $16.81 billion from long positions and $2.5 billion from short positions. More than 1.6 million crypto traders were liquidated, with massive losses seen on both sides of the market.

Many analysts attribute this event to a combination of macroeconomic uncertainty and a cascade of leveraged liquidations, which amplified the downward movement across the crypto ecosystem.

Bitcoin and Ethereum Among the Most Affected

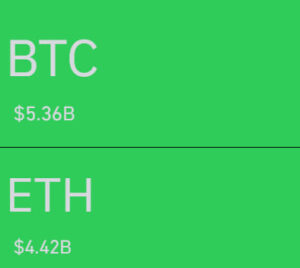

The two largest cryptocurrencies by market capitalization, Bitcoin (BTC) and Ethereum (ETH), led the liquidation wave.

According to CoinGlass data:

- Bitcoin: $5.36 billion worth of positions were liquidated.

- Ethereum: $4.42 billion worth of positions were closed.

The largest single liquidation occurred on Hyperliquid, involving the ETH-USDT pair, with a value of $203.36 million.

Crypto Market Bleeds: Bitcoin Falls Below $102,000

Following Trump’s announcement, the total cryptocurrency market capitalization dropped by more than 9%, falling to around $3.8 trillion. Bitcoin, which started Friday morning at $122,000, quickly plunged to $113,600, and briefly dipped below $102,000. Ethereum and other altcoins followed a similar pattern, with many tokens losing 15% to 25% of their value within 24 hours.

This sharp correction erased all gains made in August, marking one of the most severe market pullbacks in recent months. Analysts describe the move as “the largest single-day wipeout since February 2025.”

Tensions Behind Trump’s China Decision: Trade and Tech War Deepens

U.S. President Donald Trump announced a 100% tariff on Chinese imports, responding to Beijing’s recent restrictions on the export of rare earth elements. China’s Ministry of Commerce had recently imposed a licensing requirement for the export of strategic minerals — a move that could disrupt U.S. supply chains and increase production costs.

Trump stated that he would implement a “major increase in tariffs to protect U.S. interests.” He also canceled his planned meeting with Chinese President Xi Jinping, but added that he would be open to lifting the tariffs if Beijing backs down by November 1.

These remarks triggered a wave of risk-off sentiment across global markets. Commodities, stocks, and cryptocurrencies all fell simultaneously in response.

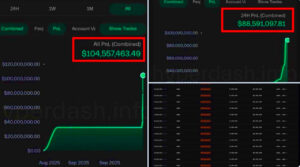

Whales and Professional Derivatives Traders Profit

While the majority of investors suffered losses from the massive liquidations, some professional traders seized the opportunity. A “whale” trading on the Hyperliquid exchange reportedly made an estimated $190 million profit after opening nine-figure short positions on Bitcoin and Ethereum just before the crash.

Such moves once again highlight how experienced leveraged traders can react swiftly and profitably during times of extreme market volatility.

Expert Opinions: “Macro Shocks Trigger a Domino Effect in Crypto”

Financial analyst Lydia Han commented on the development, saying:

“Trump’s tariffs have impacted not only trade flows but also global risk appetite. The crypto market remains the most sensitive asset class to such macro shocks.”

Another analyst, Michael van de Poppe, noted:

“These kinds of liquidations usually occur when the market is heavily overleveraged. However, in the long run, such shakeouts pave the way for more sustainable price action.”

Trump’s tariff decision has led to billion-dollar liquidations across the crypto market. In the short term, volatility is expected to remain high, but experts believe this wave of liquidations could serve as a healthy correction, helping the market flush out excessive leverage and stabilize over time.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.