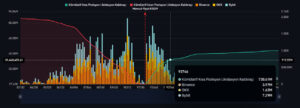

After falling below $90,000 over the weekend, Bitcoin (BTC) started the new week with a gradual recovery. However, the current price range carries serious liquidation risks for both long and short positions due to heavy leveraged trading in the market. Coinglass data shows that even a move of a few thousand dollars could liquidate hundreds of millions of dollars in positions. This indicates that Bitcoin is currently trading in a highly sensitive zone, where even a slight increase in volatility could quickly destabilize the market.

Above $93,000: $730 Million in Shorts Will Blow Up

According to Coinglass’s latest liquidation heatmap, the most critical upside level for Bitcoin lies at $93,000. If this level is breached:

- $730 million worth of BTC shorts are expected to be liquidated

- Such a short squeeze could accelerate price gains dramatically

- In periods of low liquidity, these liquidations can trigger much sharper movements

Analysts note that the $93,000 level is not just a technical resistance, but also a “red line” for highly leveraged traders.

Below $90,000: $340 Million in Longs Will Be Wiped Out

On the other hand, if Bitcoin again drops below $90,000, the situation becomes extremely risky for long holders. Coinglass data shows that a break below this level could trigger the liquidation of $340 million worth of long positions.

A liquidation of this scale would not only push prices down, but could:

- Trigger cascading liquidations

- Lead to a sharper and faster downside move

- Increase panic selling and volatility

Currently, Bitcoin is trapped between resistance at $93,000 and support at $90,000. Whichever level breaks will likely determine the market’s short-term direction, creating a highly risky environment for traders.

Market Update: Altcoins Also Recovering

As Bitcoin climbed above $91,000, sentiment across the market turned positive:

- Ethereum (ETH): above $3,100

- XRP: up 2.6% in 24 hours

- Solana (SOL): up 2.2%

However, analysts stress that the sustainability of this rebound will depend largely on the upcoming Fed meeting and Jerome Powell’s statements.

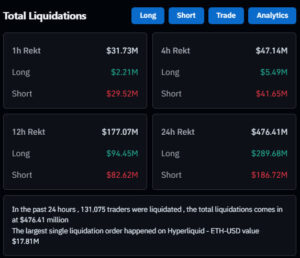

Liquidation Data: $476 Million Wiped Out in 24 Hours

The last 24 hours of liquidation data clearly highlight the market’s fragility:

- Total liquidations: $476 million

- Long liquidations: $289.68 million

- Short liquidations: $186.72 million

- Number of traders liquidated: 131,075

- Largest single liquidation: ETH/USD on Hyperliquid exchange

These figures show how vulnerable the market is.

Entering a High-Risk Zone Ahead of the Fed

Bitcoin’s price movement between $93,000 and $90,000 is currently the most important factor shaping market leverage. Breaking either level could trigger the liquidation of hundreds of millions of dollars in positions, potentially leading to sudden and violent price swings.

In this environment, traders may need to:

- Reduce leverage

- Be cautious amid high volatility

- Closely monitor upcoming Fed decisions

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.