The spotlight in the crypto market has turned once again to Ethereum (ETH), as on-chain data and market indicators suggest that the asset might be on the verge of a massive short squeeze. With over $10 billion in open short positions, analysts warn that a wave of liquidations could propel ETH above the $4,500 level.

Short Positions Face Liquidation Risk

After dropping to $3,200, Ethereum has rebounded and stabilized around $3,600. However, this recovery has put many late short positions under pressure. On-chain data shows a major liquidity cluster above $3,600, with roughly $10 billion in short positions concentrated between the $3,600–$4,500 range.

This setup means that a sharp price rally could force short sellers to close their positions, triggering a short squeeze. Analysts say that if ETH sustains momentum above $3,600, it could rapidly surge toward the $4,500 mark.

Whales and Institutions Are Accumulating

Large investors appear to be positioning themselves for this potential breakout. Whale wallets have been accumulating ETH heavily between $3,000 and $3,400, while institutional players have started opening long positions.

One well-known whale, previously noted for shorting Bitcoin, reportedly opened a 5x leveraged long position worth 40,000 ETH (~$138 million) last week. Meanwhile, BlackRock recently acquired $35 million worth of ETH, signaling renewed institutional interest. Experts believe these moves show that whales see greater short-term upside potential in Ethereum compared to Bitcoin.

Market Sentiment Turns Bullish

On-chain sentiment data also supports this view. The “smart money” cohort has turned more optimistic than retail traders, with the market sentiment index climbing from 0.21 to 0.23. The overall crypto market has gained 1.35% in the past 24 hours, further reinforcing growing confidence — a factor that could fuel another upward leg for Ethereum.

Can Ethereum Reach $4,500?

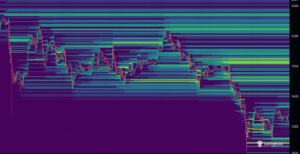

According to technical analysis, ETH must break through key resistance levels at $3,460, $3,900, and $4,200 to reach $4,500. Liquidity heatmaps show a dense cluster of short liquidations above these zones, suggesting that a rapid move upward could accelerate once those levels are breached. A short squeeze could trigger forced liquidations, amplifying buying pressure and driving ETH toward new local highs.

Outlook

Ethereum stands at a critical turning point. With whale accumulation, rising institutional demand, and billions in short positions at risk, the stage is set for a potential strong bullish reversal. If a short squeeze is triggered, Ethereum could indeed break past $4,500 — though analysts caution that such moves often come with high volatility and short-term corrections.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.