BNB has achieved a historic record thanks to the strong performance of the Binance ecosystem. According to Binance’s latest market data, the token surpassed the $1,100 level, reaching an all-time high. This movement is directly linked to both the increasing use cases within the Binance ecosystem and the growing interest from investors.

BNB Surpasses Record Level

In the last 24 hours, BNB gained 7.27%, trading at $1,108.17. This surge particularly reflects the strong token usage within the Binance ecosystem and the rising investor demand. BNB is actively used across the platform in many areas, from discounts on trading fees to staking opportunities and participation in Launchpad projects.

Experts note that such use cases support the token’s long-term value and create a confidence-boosting factor across the market. Moreover, the rise of BNB also signals a broader recovery in the cryptocurrency markets.

Futures and Liquidations

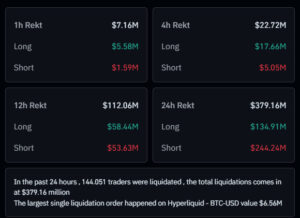

Market volatility was also reflected on the futures side. According to Coinglass data, a total of $379 million worth of positions were liquidated in the last 24 hours. Of this, $244 million came from short positions, while $134 million came from long positions.

This indicates that investors using leverage were particularly affected by sudden price movements. Analysts emphasize that high liquidation volumes can lead to sharp price swings, making it important for investors to exercise caution against volatility.

Analysts’ Views on BNB’s Rise

Crypto analysts link BNB’s historic peak not only to its use cases within the Binance ecosystem but also to broader market recovery signals. The increase in investor demand and Binance’s diverse product offerings are among the key factors driving BNB’s value upward. Meanwhile, liquidations in the futures market indicate that short-term volatility may continue.

Experts advise that while investors consider BNB’s potential gains, they should remain cautious of sudden price swings. This rise highlights BNB not just as an ecosystem token but also as an investment asset sensitive to market sentiment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.