Institutional interest in the crypto market is rising again. Spot ETF products have drawn attention with rising volumes and steady fund flows. Especially the recovery signals seen in Bitcoin and Ethereum suggest renewed investor confidence.

Strong Inflows into Bitcoin Spot ETFs

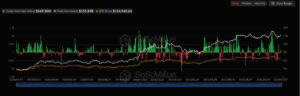

As institutional fund flows gain traction, Bitcoin ETFs recorded a net inflow of $149.30 million on October 27 — marking the third consecutive day of positive inflows.

Analysts say this trend underscores increasing investor confidence and sustained demand for BTC. They further note that the inflows are coming especially from large U.S.-based funds, and could exert upward pressure on prices in the coming weeks.

Ethereum ETF Inflows Also Strengthen

Parallel to Bitcoin, Ethereum ETFs also showed a strong performance on October 27. According to data, a total net inflow of $133.91 million was recorded, with no outflows across all nine funds.

This indicates a decrease in selling pressure and the beginning of new institutional inflows in the ETH ETF market. Analysts say this trend is supported by both the recovery in the DeFi ecosystem and the upcoming protocol upgrades, which are bolstering confidence in Ethereum’s long-term outlook.

For three consecutive days, both Bitcoin and Ethereum ETFs recorded consistent net inflows, reinforcing overall confidence in the crypto market. Analysts note that if institutional fund inflows continue, this trend could positively impact the prices of both Bitcoin and Ethereum. This pattern once again highlights that ETFs have become a key stabilizing factor in the cryptocurrency market.

Assessment

As of October 27, the recorded inflows into Bitcoin and Ethereum ETFs demonstrate a renewed rise in institutional investor confidence. The three-day streak of positive fund movement in both assets is seen as a signal of strengthening bullish momentum in the market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.