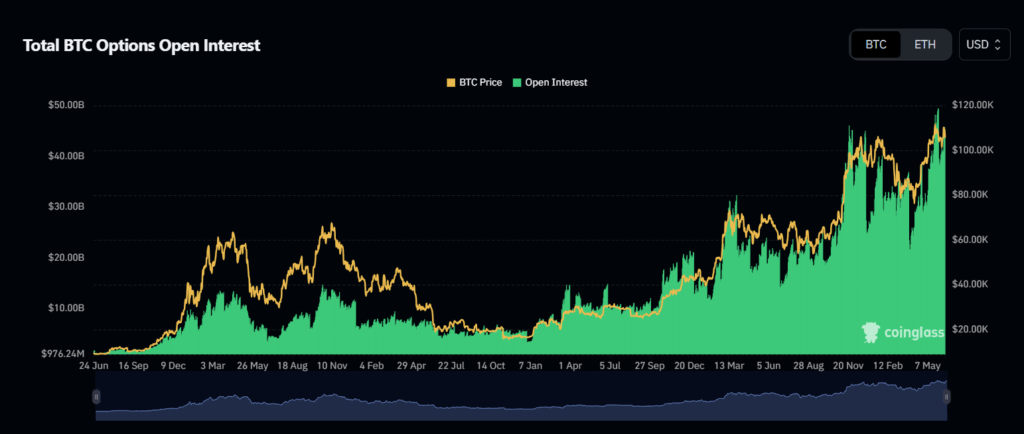

Today, Bitcoin (BTC) and Ethereum (ETH) options contracts with a total nominal value exceeding $3.5 billion are expiring in the crypto markets.

A Critical Day for Bitcoin and Ethereum Options

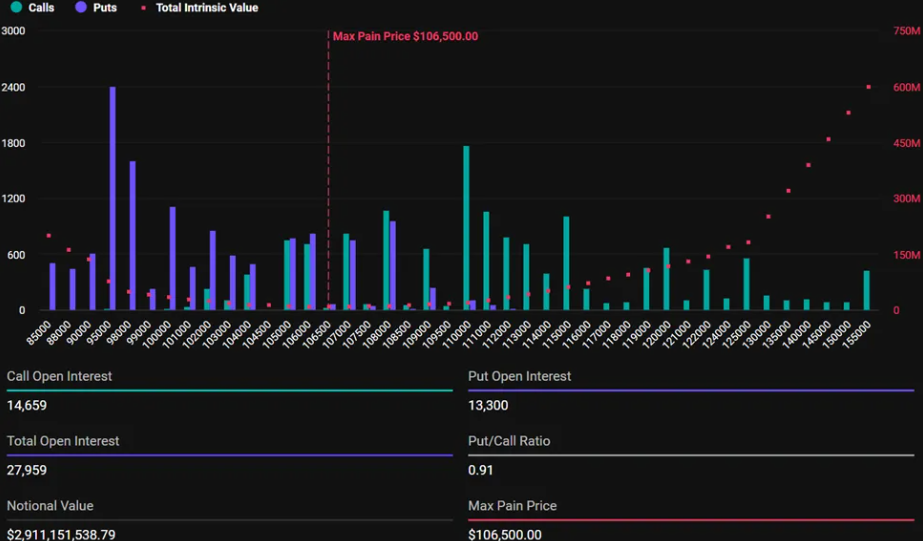

According to Deribit exchange data, approximately 27,959 Bitcoin options contracts are reaching expiration today. The total nominal value of these contracts is around $2.9 billion. Another notable data point is Bitcoin’s max pain level set at $106,500, which represents the price point where option holders experience the greatest loss.

Looking at the put-to-call ratio, Bitcoin stands at 0.91, indicating that investors still lean towards a bullish market sentiment. While some traders hold bearish positions, confidence in a price increase remains stronger.

Put Options Dominate Ethereum

On the other hand, the situation is different for Ethereum. Today, 246,849 Ethereum options contracts are expiring with a total nominal value of approximately $617.6 million. The max pain point for Ethereum is set at $2,650. Ethereum’s put-to-call ratio has reached a significant 1.14, showing that put options are more favored than calls, and investors are seeking greater protection against downside risks.

Geopolitical Developments and Increased Volatility

The timing of these option expirations is not coincidental. The Israel-Iran tensions in the Middle East have shaken investor confidence. Notably, implied volatility for Ethereum has shown a marked increase, suggesting potential sharp price movements in the coming days. Meanwhile, Bitcoin’s volatility remains relatively stable, implying a more steady short-term outlook for BTC.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.