The debate over the duration of Bitcoin’s bull run is intensifying. Analysts suggest that October could mark a potential peak, supported by historical 1,060-day cycles. This perspective comes as Bitcoin enters what is statistically its weakest month, September.

Bitcoin Cycles and October Outlook

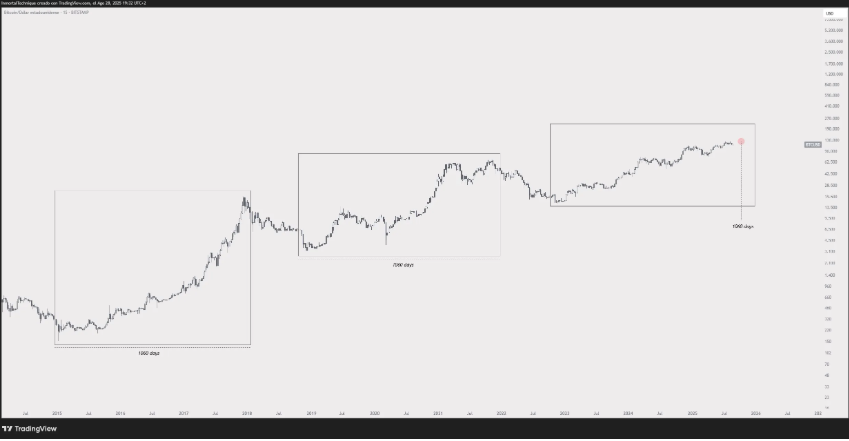

Analyst Inmortal noted that previous bull runs lasted around 1,060 days. His chart highlighted boxes marking each cycle from bottom to top. Inmortal stated, “If history repeats, the bull run ends in October.” Analyst Jelle echoed this view, pointing out that Bitcoin may only have around 55 days left in this cycle.

At the same time, Jelle emphasized altcoin behavior. He argued that Solana and Ethereum are preparing for new price levels since altcoins often peak a month after BTC. Analyst Ali reinforced this with technical evidence, citing a weekly RSI divergence. The same signal preceded the 2021 bear market, raising further caution.

September Weakness and Macro Factors

Bitcoin faces its weakest month historically as September approaches. Coinglass data shows an average return of –3.77% during this period. Indicators such as Spot Taker CVD and BTC’s Taker Buy/Sell Ratio also reflect mounting selling pressure. However, market sentiment remains as important as technical indicators. Colin Talks Crypto highlighted this point, saying, “We haven’t seen peak euphoria yet.”

Meanwhile, the Federal Reserve’s upcoming rate decision could strongly influence Bitcoin’s direction into year-end. Volatility in September may reshape investor strategies across the market. Bitcoin’s bull run has already entered its third year, with price levels still below the widely anticipated $100,000 mark. Investors seem to focus more on the scale of the rally rather than its duration. Moreover, altcoin momentum continues to indirectly affect Bitcoin’s trajectory.

In the end, technical signals suggest that October could become a turning point. Yet sentiment and macroeconomic events may shift the timeline. This makes the coming weeks a decisive phase for Bitcoin’s future direction.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.