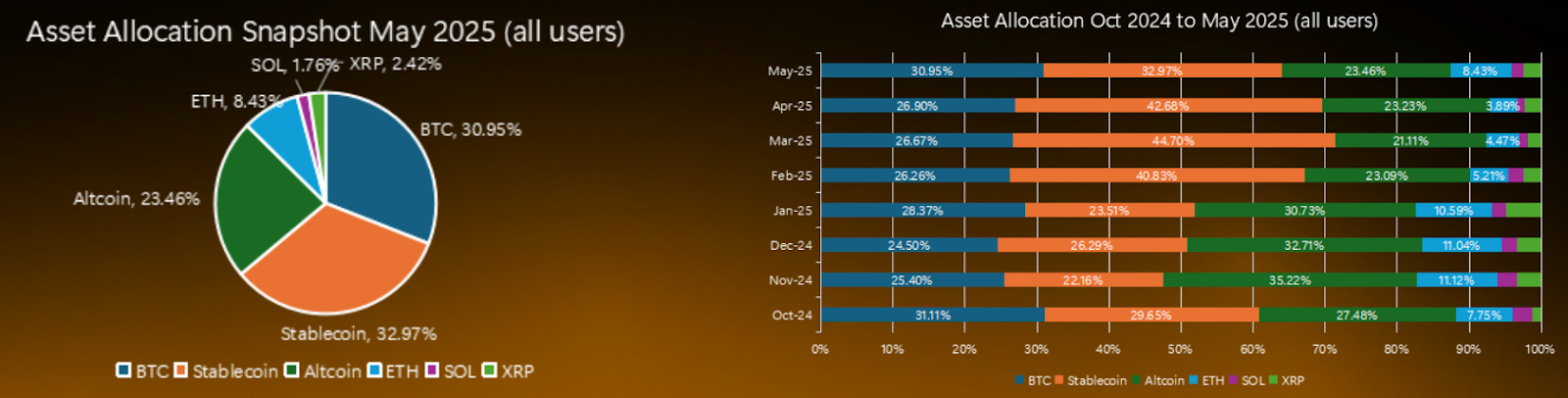

The dominance of Bitcoin in the crypto market is once again on the rise. By 2025, growing institutional interest and more innovation-friendly regulations in the United States have significantly boosted Bitcoin’s share in investment portfolios. According to the latest data, Bitcoin now makes up 30.95% of total investor crypto assets — up from 25.4% in November 2024 — making it the largest single crypto asset held.

Institutional Demand Surges, Ethereum Loses Ground

The balance between Ethereum and Bitcoin holdings has shifted noticeably. In April 2025, the ETH/BTC ratio dropped to a yearly low of 0.15, indicating that for every $1 in Ethereum, investors held roughly $4 in Bitcoin. Although the ratio has since recovered to 0.27, Bitcoin’s dominance remains clear in investor sentiment.

A New Era with Spot Bitcoin ETFs

The launch of spot Bitcoin ETFs has been a major catalyst for institutional adoption. These financial products opened the door for traditional investors to gain exposure to Bitcoin without managing wallets or private keys. Since then, Bitcoin has outperformed key asset classes — including equities, bonds, and precious metals — further solidifying its role as a portfolio diversification tool.

Corporate Treasury Holdings Are Soaring

Along with growing adoption, the number of companies holding Bitcoin on their balance sheets has nearly doubled. In early June, only 124 companies held BTC, but within weeks, that number jumped to 244. In total, corporate treasuries now hold approximately 3.45 million BTC. Of these, about 834,000 BTC are in public company reserves, while over 1.39 million BTC are held through spot ETFs.

Bitcoin’s 2035 Outlook: A Challenger to Gold

As Bitcoin continues its institutional rise, some analysts project it could rival gold’s $22 trillion market cap within the next decade. If this scenario unfolds, Bitcoin could reach a staggering $1.8 million per coin by 2035, reshaping global financial markets in the process.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.