Crypto markets have suffered another sharp sell-off, a pattern that has become increasingly familiar in recent weeks. Total market capitalization erased roughly $140 billion within hours. With the bitcoin drop accelerating, the market edged dangerously close to the $3 trillion threshold.

The sell-off, led by BTC, confirmed expectations that the week would be highly volatile. Bitcoin fell to $85,150, marking its lowest level since the major leverage flush on December 2. Market stress indicators climbed to their highest levels since the 2022 bear market, revealing that pressure had been building beneath the surface for weeks.

At this point, the question dominating investor sentiment is clear: why did Bitcoin fall, and how deep did liquidations go? In this report, we examine the data and market forces that triggered the latest breakdown.

What Analysts Are Saying

Analysts point to different catalysts behind the sell-off, but there is broad agreement that the market remains fragile.

Analyst NoLimit attributed the decline to China, claiming that authorities tightened restrictions on domestic Bitcoin mining once again. According to NoLimit, the move forced local miners offline and added pressure to the network. The analyst also suggested that the Bank of Japan could add further downside pressure to Bitcoin this week.

Another analyst, Sykodelic, argued that derivatives markets were the real source of stress. He highlighted elevated open interest levels, noting that bearish positioning has become widely accepted. As traders increasingly chase downside moves with short positions, short-side liquidity continues to rebuild, reinforcing persistent selling pressure.

Deribit data supports this view. Roughly $2 billion in open interest is concentrated around the $85,000 strike price. As Bitcoin approaches this level, short sellers often hedge by selling spot or futures, amplifying downside momentum.

Glassnode analyst James Check emphasized that stress signals are flashing across the market. “Bitcoin market stress is now the highest we’ve seen since the 2022 bear market,” he noted.

On-Chain Data Signals Rising Stress

Market indicators further highlight the depth of the sell-off. According to James Check’s analysis:

• Unrealized losses have reached nearly $100 billion

• Hash rate has started to trend lower

• Around 60% of spot Bitcoin ETF inflows are now underwater

• Bitcoin-related treasury stocks are trading below their net asset values

Data shows that during the bitcoin drop, a large portion of spot ETF inflows slipped into loss territory, increasing pressure on institutional sentiment.

US Crypto Legislation Delay Proves Decisive

The most critical trigger behind the sell-off appears to be regulatory developments in the United States. A spokesperson for the US Senate Banking Committee confirmed that a crypto market structure bill will not advance this year.

“The Committee continues to negotiate and looks forward to a markup in early 2026,” the spokesperson said. The announcement effectively removed expectations for near-term regulatory clarity.

The proposed legislation would have granted the CFTC authority over spot crypto markets. The industry had widely expected progress before year-end, but pushing the timeline into 2026 has introduced fresh uncertainty, particularly for institutional investors.

Liquidation Data Reveals the Scale of the Move

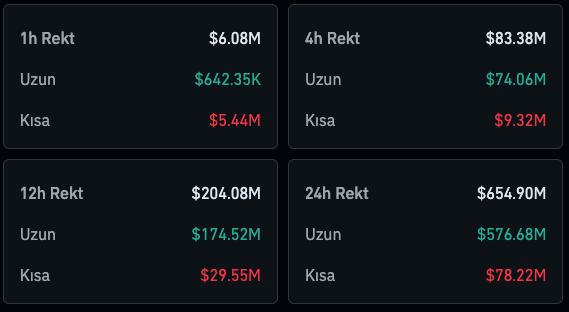

Bitcoin’s drop to $85,150 triggered widespread liquidations. Over the past 24 hours, approximately $654.9 million in positions were wiped out.

• Long positions: $576.68 million

• Short positions: $78.22 million

The dominance of long liquidations shows that bullish traders absorbed most of the damage. The market went through a sharp deleveraging phase, clearing excessive leverage built up during previous rallies.

Taken together, regulatory uncertainty, extreme derivatives positioning, and rising on-chain stress converged at once. This combination erased $140 billion from the crypto market within hours. Current conditions suggest that bitcoin drop risks have not fully dissipated in the short term, leaving markets highly sensitive to upcoming macro and regulatory signals.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.