Bitcoin investor behavior has crossed a critical threshold. According to CryptoQuant’s on-chain assessment dated January 22, 2026, Bitcoin holders have entered a net realized loss phase for the first time since October 2023. In practical terms, profit distribution has faded, replaced by a growing tendency to lock in losses and move into cash.

Data shows that since December 23, roughly 69,000 BTC in net realized losses have been recorded on-chain. This marks a clear departure from the profit-taking environment that dominated most of 2024 and 2025. Instead of distributing coins at a gain during price rebounds, investors are now choosing to crystallize losses.

A Quiet Shift in On-Chain Behavior

CryptoQuant emphasizes that this transition cannot be explained by price action alone. In fact, weakness in profit realization has been building for some time. On-chain metrics indicate that Bitcoin holders are stepping away from profitable distribution and prioritizing risk reduction instead. Historically, similar behavioral shifts have emerged when market conviction weakens and price recoveries fail to sustain momentum.

What stands out in the current phase is the absence of panic selling. Selling pressure is developing gradually rather than explosively. This suggests that while market participation remains active, confidence in directional continuation is eroding.

Signs of Fatigue in Profit Momentum

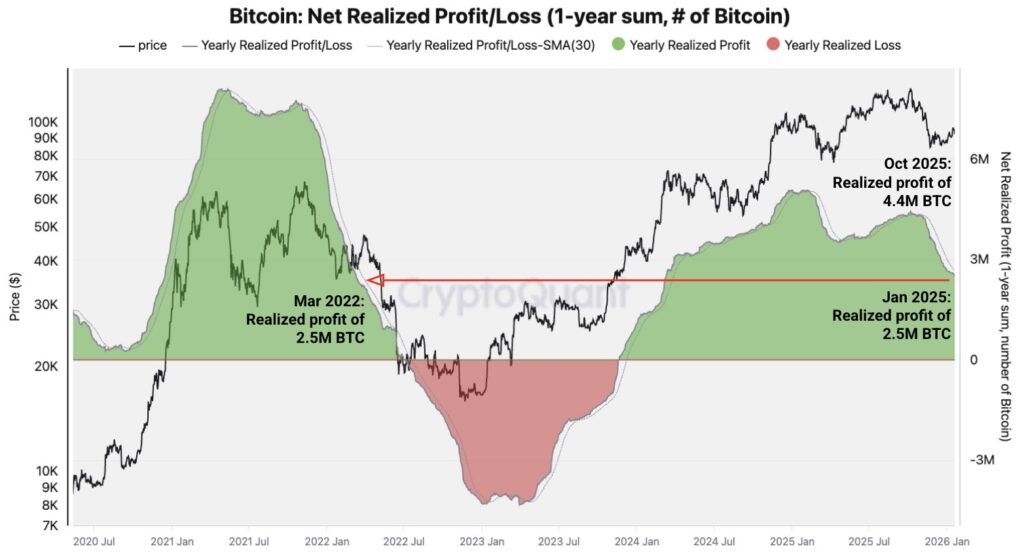

CryptoQuant data shows that realized profit momentum has been steadily deteriorating since early 2024. Rather than a single breakdown point, the market has produced a sequence of progressively lower realized profit peaks—first in January 2024, followed by December 2024, July 2025, and most recently October 2025.

This pattern reveals that even when spot prices appear resilient, each rally generates less profit-taking than the previous one. From an on-chain perspective, this reflects declining willingness among buyers to absorb supply at higher price levels, signaling weakening demand strength.

Parallels With the 2021–2022 Market Transition

CryptoQuant analysts note that the current on-chain structure bears striking similarities to BTC 2021–2022 bull-to-bear transition. During that cycle, realized profits peaked in early 2021 and then formed lower highs throughout the year before flipping into net realized losses ahead of the 2022 bear market.

That loss realization phase coincided with a broader psychological shift—from optimism toward capital preservation—and unfolded alongside a prolonged market decline. While history does not repeat mechanically, CryptoQuant frames the resemblance not as a forecast, but as a structural warning signal.

Where Is Market Balance Headed?

CryptoQuant stresses that net realized losses alone do not guarantee an immediate price collapse. However, in past cycles, extended loss realization phases have typically aligned with weaker market sentiment and diminishing speculative appetite.

If the current trend persists, Bitcoin rallies may increasingly encounter selling pressure, while downside volatility becomes more visible as the market searches for a new equilibrium. The direction remains unresolved, but on-chain data suggests the market is operating under noticeably tighter conditions than before.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.