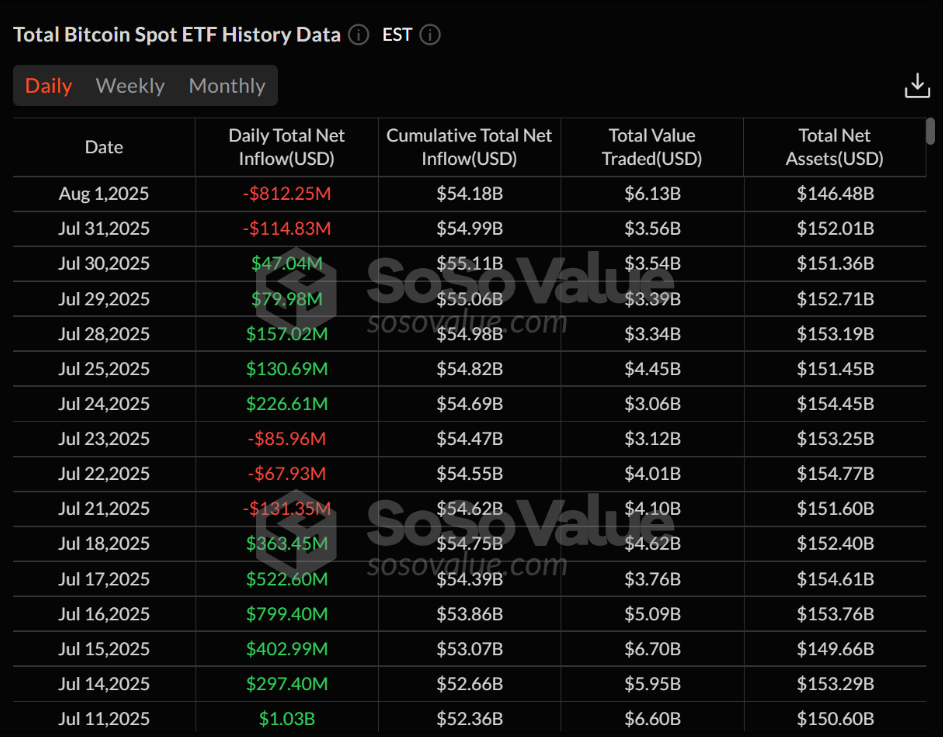

Spot Bitcoin ETFs saw a massive $812.25 million in net outflows on Friday, marking the second-largest daily loss in their history. This sharp drop ended a week-long run of consistent inflows. According to SoSoValue, the cumulative net inflow for Bitcoin ETFs fell to $54.18 billion.

During this period, total assets under management (AUM) declined to $146.48 billion. This figure represents roughly 6.46% of Bitcoin’s market capitalization. Fidelity’s FBTC led the outflows with a $331.42 million redemption by investors.

ARK Invest’s ARKB product followed closely with a $327.93 million withdrawal. Grayscale’s GBTC recorded $66.79 million in losses, while BlackRock’s IBIT saw a relatively minor $2.58 million outflow.

Despite the decline, trading volumes across spot Bitcoin ETFs remained strong. The total volume reached $6.13 billion, with BlackRock’s IBIT contributing $4.54 billion alone. This indicates continued investor interest despite the volatility.

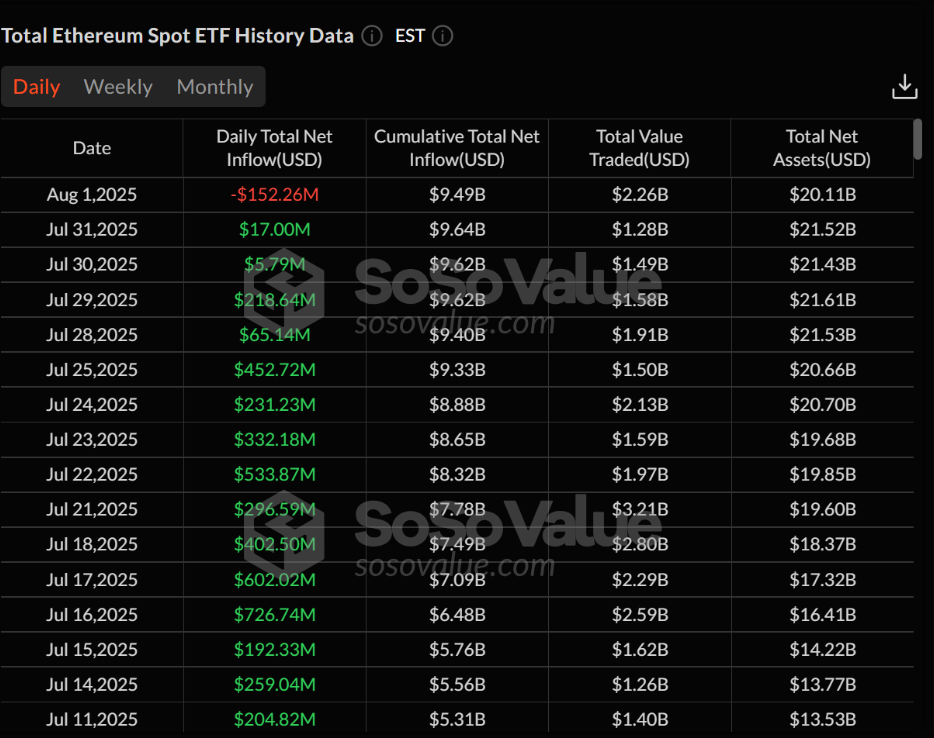

Ether ETFs End 20-Day Inflow Streak with $152M Outflow

Meanwhile, spot Ether ETFs ended their longest-ever inflow streak on Friday, following 20 consecutive trading days of net inflows. That day, the sector recorded $152.26 million in total outflows. As a result, Ether ETF AUM dropped to $20.11 billion.

This amount equals about 4.70% of Ethereum’s market cap. Grayscale’s ETHE led the withdrawals with a $47.68 million outflow. Bitwise’s ETHW product followed with a $40.30 million reduction, and Fidelity’s FETH recorded a $6.17 million decline.

On the other hand, BlackRock’s ETHA remained flat for the day, reporting no inflows or outflows. Its assets under management held steady at $10.71 billion.

Across all Ether ETFs, total trading volume hit $2.26 billion. Grayscale’s ETHE contributed the most, with $288.96 million in daily volume, reflecting ongoing market volatility.

Institutional Demand Rises: Ethereum Accumulation Accelerates

According to a recent report by Standard Chartered, institutional investors have increased their Ethereum purchases. Since early June, crypto treasury firms have acquired roughly 1% of Ethereum’s circulating supply.

This steady accumulation, combined with consistent inflows into U.S. spot Ether ETFs, has become a key driver of Ethereum’s recent price rally. The bank projects that ETH could surpass $4,000 by year-end.

Meanwhile, analysts highlight staking and DeFi participation as added incentives for corporate holdings. They believe that Ethereum’s share in institutional portfolios could grow significantly—possibly reaching up to 10% of total supply over time.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.