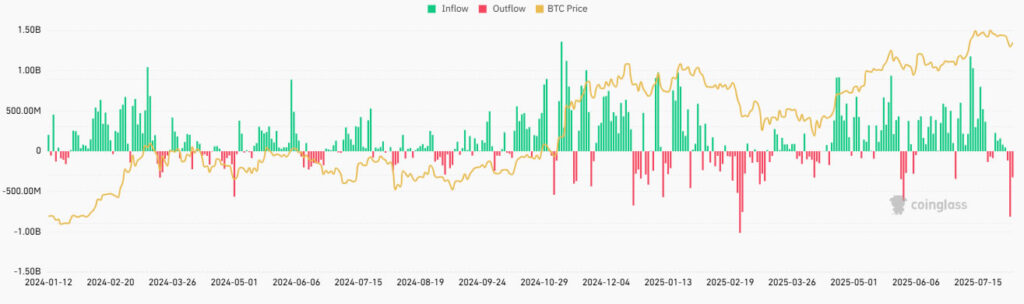

BlackRock’s iShares Bitcoin Trust (IBIT) experienced its largest outflow in nine weeks. On Monday, August 4, 2025, the fund saw investor redemptions totaling $292.5 million. This came after a smaller outflow on Friday, ending IBIT’s 37-day streak of consecutive inflows.

Bitcoin has been losing value since hitting a peak of $114,278 on July 14. Over the weekend, BTC dropped by 8.5%, falling to $112,300 before recovering to around $115,000 late Monday. However, this rebound wasn’t enough to prevent ETF outflows.

The $292 million outflow from IBIT represents just 9% of the $5.2 billion in net inflows recorded in July. While relatively small in the broader context, the outflow is still notable.

Decreasing Interest in Spot Bitcoin ETFs: What Are Institutional Investors Doing?

U.S.-listed spot Bitcoin ETFs saw outflows for a third consecutive trading day. Fidelity’s FBTC lost around $40 million, and Grayscale’s GBTC recorded a $10 million outflow. Other U.S.-based ETFs saw no significant inflows, except Bitwise’s BITB fund, which attracted $18.7 million.

These developments came as Bitcoin bounced off the $112,000 support level. Notably, Monday’s total ETF outflow was smaller than Friday’s $812 million, indicating a potential slowdown in redemptions.

Still, digital asset investments remain significant in institutional portfolios. Bloomberg ETF analyst Eric Balchunas noted that while growth in private investment vehicles is slowing, hedge funds and digital assets are gaining market share. JPMorgan analyst Nikolaos Panigirtzoglou echoed this sentiment, pointing to substantial capital inflows into digital assets.

As of July 22, investment in digital assets reached $60 billion, down from $85 billion last year. This underscores the growing prominence of digital assets among alternative investment options.

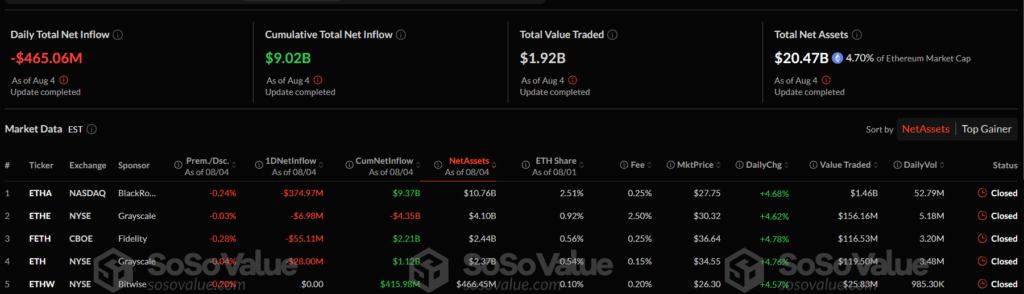

Spot Bitcoin and Ethereum ETFs listed in the U.S. recorded a combined $787 million in net outflows as of August 4, 2025. Spot Bitcoin ETFs lost $322 million, while Ethereum ETFs saw a $465 million capital exodus.

BlackRock’s ETHA fund alone saw a massive $374.97 million outflow. On the same day, Fidelity’s FETH fund lost $55.11 million, and Grayscale’s ETHE recorded a $6.98 million outflow. Bitwise’s ETHW was the only Ethereum ETF to register inflows, pulling in $415.98 million.

Despite this, Ethereum ETFs’ total net asset value has reached $20.47 billion, equivalent to 4.70% of Ethereum’s market cap.

Volatility Drops, Bitcoin Attracts New Investors

According to Balchunas, Bitcoin has not experienced major volatility since the launch of spot ETFs. The 90-day volatility, which hovered above 60 in January 2024, has fallen below 40 for the first time in IBIT. This decline makes Bitcoin appear more stable.

As a result, BTC has become a more attractive asset for institutional investors. Lower volatility has facilitated its adoption both as an investment vehicle and an alternative currency.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.