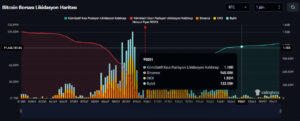

In the cryptocurrency market, Bitcoin continues to hold around the $90,000 level after briefly rising to $94,800 earlier this week. However, data from Coinglass indicates that even a small price move could trigger large-scale liquidations. A key point for investors is that if Bitcoin approaches $95,000, more than $1.2 billion in short liquidations would be at risk.

Bitcoin Holds Above $90,000

Bitcoin, the largest cryptocurrency by market capitalization, climbed to $91,500 by Friday midday, approaching key resistance levels. Cautious investor behavior and broader market uncertainty have limited sharp price movements. Despite low liquidation levels and limited directional bets, Bitcoin has managed to remain stable above $90,000.

This situation suggests that investors are undecided about the next clear direction and are maintaining a cautious stance toward market movements. At the same time, consolidation at these levels presents both potential opportunities and risks for short-term traders. While Bitcoin’s current position points to a generally calmer market, it also serves as a reminder that even small price changes can create significant volatility.

Coinglass Data: Short Positions at Risk

According to data from Coinglass, if Bitcoin rises back to $95,000 in Binance’s perpetual BTC futures, more than $1.2 billion in short positions would face liquidation risk. This shows that even a price move of around 5% could lead to a sharp increase in market volatility, posing substantial risks for investors.

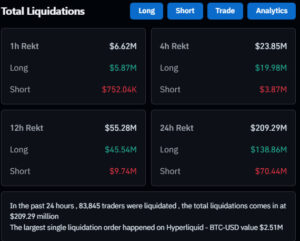

Over the past 24 hours, total liquidations across the crypto market amounted to $209.29 million, with $138.86 million of this coming from long positions. These liquidations, particularly on the long side, indicate that short-term traders are adjusting their positions in response to price fluctuations in Bitcoin and other major cryptocurrencies.

Critical Levels for Investors

Analysts note that Bitcoin approaching the $95,000 level presents both significant opportunities and risks for short-term traders. A potential sudden rally could trigger mass liquidations, leading to sharp market swings. Therefore, investors are advised to manage their positions carefully and take heightened volatility into account.

While Bitcoin continues to show stability around the $90,000 level, Coinglass data highlights the risk of billion-dollar short-position liquidations. Following the recent test of $94,800 earlier this week, even minor price movements could generate serious volatility. Bitcoin’s consolidation phase and the elevated short-position risk underline the importance of close market monitoring and cautious strategy development for investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.