Bitcoin’s recent attempt to move back toward the $90,000 level has provided short-term relief across the crypto market. However, most analysts agree that this price action does not yet signal a genuine recovery. The weakness that has characterized the second half of 2025 continues to weigh heavily on market sentiment, keeping investors cautious despite brief rebounds.

Crypto Market Cap Reclaims $3 Trillion — Cautiously

With the latest upside move, total cryptocurrency market capitalization has once again climbed above $3 trillion. This level has acted as a critical battleground between buyers and sellers over the past several weeks. While the return above this psychological threshold is notable, market participants remain unconvinced that it reflects renewed demand.

Instead, analysts describe the move as a technical response following prolonged selling pressure. After weeks of declines, lower price levels naturally attracted short-term buying, but conviction remains limited.

Technical Bounce, Not a Structural Recovery

According to FxPro Chief Market Analyst Alex Kuptsikevich, the current market strength should not be mistaken for a broader turnaround. He emphasizes that while the market is attempting to grow again, it lacks the structural support required for a sustained recovery.

Risk appetite has improved only marginally. The fear and greed index rising to 25 suggests traders are stepping away from extreme pessimism, yet remain far from embracing risk. This cautious positioning reflects lingering disappointment after the optimism seen earlier in the year faded.

Bitcoin Trapped in a Narrow Range

Bitcoin traded near $88,000 during Asian market hours, testing the upper boundary of a range that has held since early last week. The inability to decisively break higher highlights the fragility of short-term momentum.

At current levels, Bitcoin remains roughly 30% below its 2025 peak and is also trading below prices seen at the start of the year. This underperformance continues to shape investor psychology, reinforcing a sense of fatigue rather than confidence.

Fourth Quarter Performance Raises Red Flags

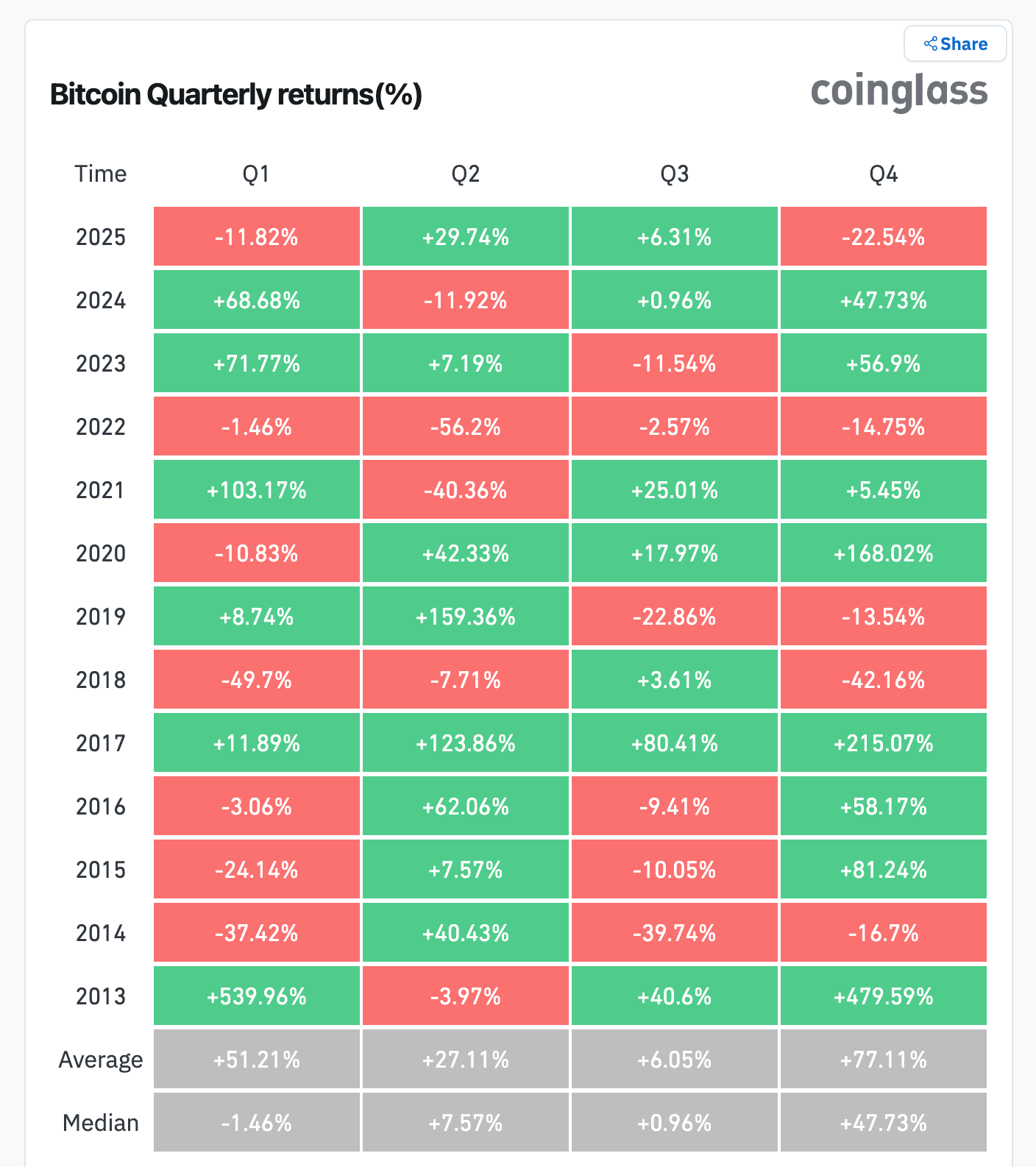

Seasonal data further supports a cautious outlook. According to CoinGlass figures, Bitcoin has declined by more than 22% so far in the fourth quarter. This places 2025 among the weakest year-end periods since 2018, outside of full-scale bear markets.

While the fourth quarter has historically delivered strong rallies, it has also produced sharp drawdowns during periods of tightening liquidity and macroeconomic uncertainty. Recent trading patterns reflect this vulnerability, with gains made during Asian and European sessions frequently fading once U.S. markets open.

For now, Bitcoin’s trajectory suggests resilience remains limited, and the market continues to search for a durable catalyst.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.