The cryptocurrency market started the week under strong selling pressure. Bitcoin fell below the $86,000 level, while Ethereum and other major cryptocurrencies also posted significant losses. Growing economic uncertainty in global markets, weakening liquidity as year-end approaches, and unclear signals from the regulatory front have significantly reduced investors’ risk appetite. In this environment, market participants have adopted a more cautious stance, and the shift away from risk assets has accelerated sell-offs across the crypto market.

Sharp Pullback in Bitcoin and Ethereum

According to data from the past 24 hours, Bitcoin declined by 4.4%, falling to as low as $85,617. The leading cryptocurrency dropping below $86,000 indicates strengthening selling pressure and rising risk perception among investors. With this decline, short-term investors have increasingly moved to protect their positions, while some have shifted toward safer assets and adopted a more defensive stance. This pullback in Bitcoin has created a broader atmosphere of uncertainty in the crypto market, leading to the testing of key technical support levels and increased short-term price volatility.

Ethereum experienced an even sharper decline compared to Bitcoin. ETH fell by 6.5% to around $2,915. This stronger pullback in Ethereum signaled rising risk perception in the altcoin market and an acceleration in selling pressure. The broader market sell-off was not limited to Bitcoin and Ethereum. Altcoins were also affected by the negative sentiment. BNB fell by 4.2%, XRP by 6.7%, and Solana by 4.5%. Experts note that this pullback is not driven by a single crypto-specific development, but rather by weakening global risk appetite and investors taking more cautious positions.

Weakness in U.S. Stock Markets Weighed on Crypto

The decline in cryptocurrencies moved in parallel with weakness in U.S. equity markets. The S&P 500 fell by 0.16%, the Nasdaq Composite by 0.59%, and the Dow Jones Industrial Average by 0.09%. As year-end approaches, declining liquidity has made investor behavior more sensitive, causing sharper and more volatile price movements in both traditional markets and crypto assets.

Presto Research analyst Rick Maeda commented on the market environment as follows:

“As we approach year-end, liquidity is clearly declining. Sell-offs in equities during U.S. trading hours are increasing selling pressure in risk assets such as crypto.”

Senate’s Delay of Crypto Legislation Weighed on Confidence

Another key factor triggering the market decline was regulatory uncertainty. The U.S. Senate’s decision to delay a bill aimed at regulating the structure of the cryptocurrency market until next year negatively affected investor confidence. The lack of regulatory clarity has increased risk perception, particularly among institutional investors, contributing to accelerated selling in the short term.

Last week’s 25 basis point interest rate cut by the U.S. Federal Reserve failed to provide a lasting recovery in the markets. Analysts note that Bitcoin slipping below key technical support levels after the rate cut has weakened expectations for a year-end rally. Upcoming U.S. inflation data will be critical in determining the market’s direction.

Claims of Mining Pressure from China

Another topic contributing to selling pressure was claims that inspections on crypto mining have been tightened in China’s Xinjiang region. Jianping Kong, President of Nano Labs and former co-chairman of Canaan, stated that hundreds of thousands of mining machines have been shut down in the region, leading to an approximately 8% drop in network hash rate. However, experts suggest that this development may have only a short-term impact and is unlikely to permanently weaken Bitcoin’s long-term fundamentals.

Liquidation Wave Deepened the Sell-Off

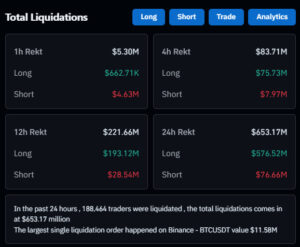

As Bitcoin fell below the $87,000 level, significant liquidations occurred in leveraged positions. The rapid price decline negatively affected investors using high leverage, leading to the closure of approximately $576 million in long positions in a short period of time. Over the past 24 hours, total liquidations exceeded $650 million, highlighting the strength of the selling pressure in the market.

The fact that the majority of these liquidations were long positions increased losses for investors who were caught off guard by the downturn. On the Ethereum side, selling pressure was even more pronounced. ETH dropped sharply by 9% within eight hours, falling to around $2,930, signaling continued fragility in the altcoin market.

Overall Assessment

The sharp decline in Bitcoin and Ethereum indicates that risk-off sentiment is strengthening in the cryptocurrency market. Declining liquidity, macroeconomic uncertainty, the Senate’s delay of crypto legislation, and heavy use of leverage are making price movements more fragile. While volatility is expected to persist in the short term, investors are advised to closely monitor global economic developments and regulatory actions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.