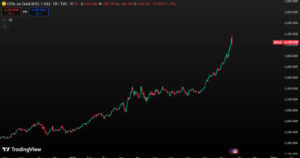

As gold renews its all-time high, Bitcoin retreats sharply amid heavy selling. Analysts note that the BTC/Gold pair has dropped to historic lows, suggesting it could be signaling the start of a new bullish cycle. Global markets have recently drawn attention with gold’s record-breaking rally and Bitcoin’s steep correction.

Gold surged to an all-time high of $4,380 per ounce as investors moved away from the U.S. dollar in search of safe-haven assets. Meanwhile, Bitcoin (BTC), after reaching its peak at $126,000, faced a sharp sell-off, declining by nearly 15%.

Gold in a Parabolic Rise, Bitcoin Taking a Breather

In the second half of 2025, gold entered a parabolic uptrend. After a relatively calm April–September period, the precious metal gained strong momentum in September. Starting the month trading around $3,400, gold climbed rapidly within weeks to reach $4,380.

In contrast, Bitcoin was caught in a wave of selling after hitting record highs in early October. According to experts, this opposite movement highlights the widening gap between safe-haven assets and risk-on assets once again.

BTC/Gold Pair at Historic Lows

The rapid surge in gold has pushed the BTC/Gold pair to historically low levels. According to data shared by crypto analyst Pat Christopher, there have been only four periods in history when Bitcoin was this undervalued against gold:

- January 2015

- November 2018

- March 2020

- November 2022

In all four instances, a similar pattern occurred: shortly after the BTC/Gold ratio hit bottom, a strong upward trend followed. For example, when a similar low was seen in 2022, the ratio nearly tripled within a few months.

Crypto analyst Pat Christopher stated:

“Bitcoin’s historically weak performance against gold has often signaled a market bottom. In the past, such levels have typically been followed by strong recoveries.”

Nick Szabo: “The Bottom Has Been Reached”

Nick Szabo, one of the leading figures in the cryptocurrency world, argues that the current levels of the BTC/Gold pair indicate a market bottom. Szabo — who is also known for speculation linking him to the invention of Bitcoin shared on X (Twitter):

“The bottom level is likely around 23 ± 4 ounces of gold. We’ve probably already reached that point.”

Szabo’s comment has been interpreted by many analysts as a potential signal that Bitcoin could be entering a new bullish cycle.

Market Commentary: Could History Repeat Itself?

According to experts, the inverse correlation between gold and Bitcoin is a classic reflection of financial market cycles. Gold typically shines during periods of economic uncertainty, geopolitical tension, and dollar weakness, while Bitcoin tends to perform strongly when liquidity increases and risk appetite returns to the markets.

Therefore, the sharp decline in the BTC/Gold ratio could be an early signal of a renewed risk-on phase. Some analysts suggest that this cycle might mark a major turning point for Bitcoin, potentially setting the stage for a strong recovery.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.