As the crypto market continues its bullish momentum, institutional capital is flooding into digital asset investment vehicles at a historic pace. In the past week alone, crypto investment products attracted a staggering $3.7 billion in net inflows, pushing the total assets under management (AUM) to a record-breaking $211 billion — the highest level ever recorded.

Crypto ETFs Dominate with $2.7 Billion in Weekly Inflows

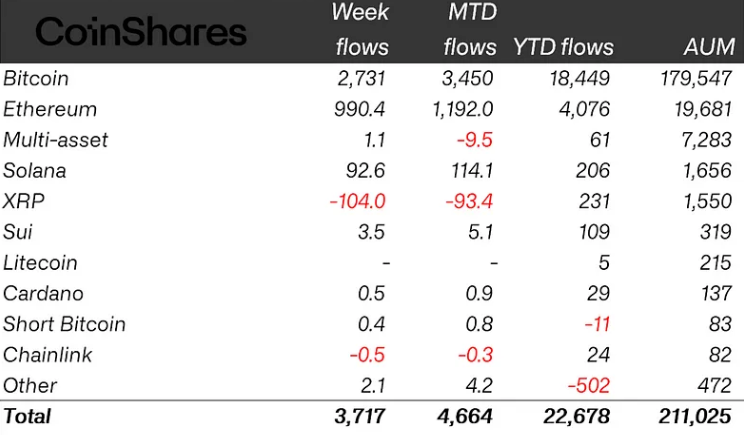

The bulk of these inflows went directly into Bitcoin-focused ETPs, which led the way with $2.7 billion, accounting for nearly 73% of all crypto product inflows. This sharp rebound follows a quieter previous week with just $790 million in inflows, highlighting renewed investor appetite as Bitcoin continues to break barriers.

On a daily basis, Bitcoin ETF inflows surged above $1 billion right after BTC soared past $112,000, setting a new all-time high midweek. The increase reflects growing confidence from large institutions and signals strong support for BTC at these elevated price levels.

Thanks to this influx, the total AUM of Bitcoin ETPs has now climbed to $179.5 billion, equaling 54% of the total assets held in gold-backed ETPs — a historical first that showcases the shifting interest toward digital assets.

Ethereum Sees 12 Straight Weeks of Institutional Demand

While Bitcoin stole the spotlight, Ethereum continued to see consistent interest from investors. Ether-based ETPs recorded their 12th consecutive week of inflows, gathering a total of $990 million — the fourth-largest weekly inflow for ETH products to date.

According to market analysts, these consistent inflows represent 19.5% of Ethereum ETP AUM, a significantly higher ratio compared to Bitcoin’s 9.8% in the same time frame. This trend suggests that investors are increasingly positioning themselves in altcoins like Ethereum alongside Bitcoin.

XRP Bleeds Capital, While Solana Shines

Not all digital assets shared the same positive momentum. XRP-related ETPs faced the largest weekly outflows, with $104 million exiting the products. In contrast, Solana continued to gain institutional favor, bringing in $92.6 million in new capital — a testament to its growing popularity among altcoin-focused investors.

US Crypto Fund Issuers Lead the Pack

The lion’s share of these inflows was captured by U.S.-based issuers, with BlackRock’s iShares crypto funds leading at $2.4 billion in net inflows. Fidelity followed with $400 million, and ARK Invest secured $339 million.

European asset manager CoinShares, however, saw modest outflows, totaling $16 million for the week.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.