Bitcoin regained momentum toward the end of the week, recovering from its recent low of $103,660 to trade above $106,000. This rebound also lifted several major altcoins — including Dash, Morpho, Bittensor, and Aster — all of which posted gains of over 8% in the past 24 hours.

Investors Seize the “Buy the Dip” Opportunity

The recent uptick in Bitcoin’s price appears to be driven by investors taking advantage of the market’s correction. Over the past few weeks, many cryptocurrencies have fallen more than 20% from their monthly highs, entering a short-term bearish phase. However, the latest rebound suggests that traders are once again stepping in to capitalize on discounted prices.

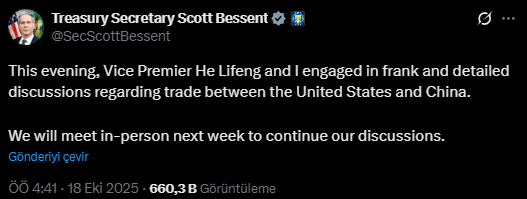

Market optimism has also been fueled by growing diplomatic expectations between the United States and China. Investors are closely watching the anticipated meeting between U.S. President Donald Trump and Chinese President Xi Jinping, which is expected to take place later this month during the Asia-Pacific Economic Cooperation (APEC) summit in South Korea.

Trade Tensions and Market Reactions

Relations between the two global powers have become increasingly strained. China has raised its average tariffs on U.S. imports to over 32%, now covering nearly all American goods. This escalation has added significant pressure to global trade and investor sentiment.

Beijing has also announced plans to implement export controls on rare earth materials and magnets, a move that could disrupt U.S. manufacturing given that China controls about 80% of the global market share in this sector.

Additionally, China has halted soybean imports from the U.S., instructed local companies to avoid Nvidia chips, and launched an investigation into Qualcomm. In response, the Trump administration is preparing to impose new tariffs of up to 130% on Chinese exports starting November 1, a steep increase from the current 30% minimum rate.

A potential trade deal between the two nations would likely be bullish for both equities and crypto markets, as it could ease geopolitical tensions and lower inflation risks. Such an agreement would also support the Federal Reserve’s ongoing interest rate cuts, reinforcing a more favorable macroeconomic environment for risk assets like Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.