Bitcoin (BTC) brief drop below $95,000 has intensified fear across the market, but several analysts caution that this move alone does not confirm the start of a prolonged bear cycle. After a sharp decline on Friday morning, BTC managed a short-lived rebound before slipping again under the same threshold later in the day. According to analysts, the wave of panic selling mainly triggered by short-term holders appears to have eased for now.

Losses Among New Investors Drive Panic Selling

CryptoQuant analyst CrazzyBlockk notes that the profitability of the newest market participants plays a crucial role in shaping Bitcoin’s price trajectory. When these fresh entrants remain in profit, they contribute confidence and liquidity, helping sustain upward momentum. However, when this cohort begins to face losses in the range of 20% to 40%, panic-driven selling tends to accelerate, placing additional pressure on the market.

The analyst emphasizes that such levels of stress often emerge during capitulation stages, but current conditions still fall short of signaling a full-scale macro bear market. If newer investors return to profitability, support could form, and the recent pullback may ultimately be classified as a “mid-cycle correction” rather than the start of a long-term decline.

Fed Outlook and Market Pressure

At the time of writing, Bitcoin is trading near $96,100, marking a 2.8% daily drop and a 7.5% decline over the past week. BTC has now slipped under $100,000 three times in the past month, pushing total liquidations above $1 billion. Prior to this period, Bitcoin had not traded below six figures since May.

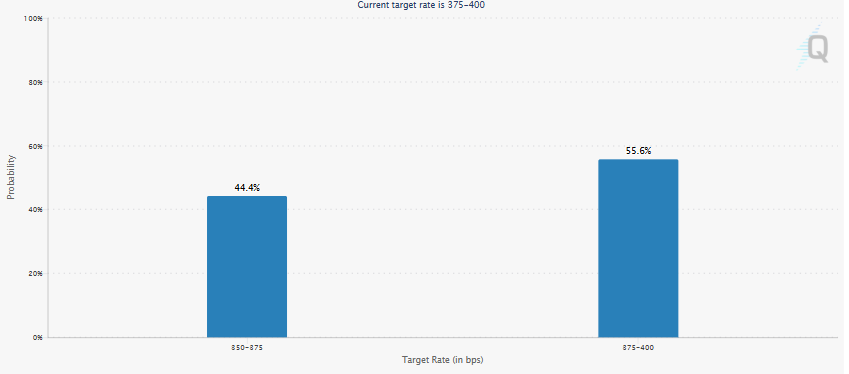

Macroeconomic expectations are also weighing on sentiment. Derivatives markets suggest that traders currently assign a 55.6% probability that the Federal Reserve will hold interest rates steady at its December 9 meeting. A month earlier, data implied near certainty that rate cuts would resume before 2026. While rate cuts typically support risk assets, ongoing uncertainty has had a disproportionately negative impact on crypto compared to equities.

Wintermute: Correlation With Nasdaq Has Become One-Sided

Analysts at Wintermute highlight that digital assets have been pricing in far more negativity than equity benchmarks such as the Nasdaq 100. With Bitcoin having defended the $100,000 level twice in recent weeks, they argue that the latest breakdown occurred under much heavier macro pressure.

What Experts Expect Going Forward

Pepperstone Research Strategist Dilin Wu warns that the market has yet to show signs of a durable recovery, urging traders to remain cautious in the near term. She adds that Bitcoin still holds the potential to revisit new highs over the medium to long term, provided that sentiment improves, liquidity returns, and volatility subsides. While the four-year cycle can offer context, Wu stresses that real market participation and funding conditions are ultimately more important than relying solely on cyclical patterns.

As the market navigates conflicting signals, investors continue to watch closely to determine whether Bitcoin’s downturn marks a temporary pause—or something more significant.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.