Bitcoin (BTC) entered a short-term correction phase after posting a strong rally at the beginning of January. Despite the temporary price pullback, accumulated liquidity and capital flows in the market are providing important signals that could support buying opportunities and a potential recovery for BTC. This suggests that, thanks to resting orders on exchanges and sidelined capital, Bitcoin may have the ability to rebound after declines.

Bitcoin Price Action and Short-Term Risks

On Monday, January 5, Bitcoin reached a local peak of $94,700. After hitting this high, the price faced the possibility of a pullback toward $80,600. By the end of the day, BTC was trading around $92,500, marking a decline of approximately 2.40%.

While this move points to short-term downside risk, sidelined market liquidity could help support a recovery in Bitcoin’s price. In particular, liquidation levels above $94,500 and liquidation clusters below $84,000 stand out as critical zones that could limit potential price fluctuations. These levels provide investors with important signals regarding the possible direction of price movements.

Buying Power and Capital Flow Signals

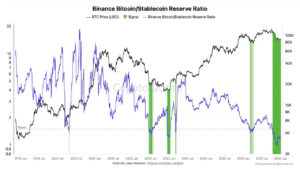

CryptoQuant Insights analyst Darkfrost noted that current BTC/stablecoin data remains quite constructive. New stablecoin inflows to exchanges and the corrections seen in December indicate that significant buying power is still present in the market. This may signal the early stages of increased capital deployment starting from early January.

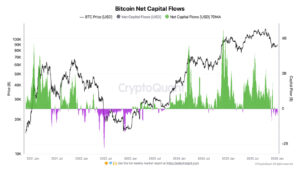

Analyst Axel Adler observed that overall capital flows were negative between December 26 and January 3, meaning realized losses outweighed realized profits. However, over the weekend, capital flows turned slightly positive, indicating that realized profits have begun to exceed losses marginally. Glassnode data also confirms that the recent rally is aligned with this shift.

Bitcoin’s 7-day moving profit/loss ratio remained below 1 for most of December, but has risen back to 1.78 since the beginning of January. When combined with a decline in circulating BTC supply and strong ETF inflows, this increase stands out as an indicator supporting the possibility of further gains for Bitcoin in the coming weeks.