While Bitcoin price action remains volatile in the short term, on-chain indicators suggest that the internal health of the market is gradually strengthening. Recent developments in spot market activity and declining sell-side pressure point to a consolidation phase that appears more constructive than fragile, signaling a slow but steady rebuilding process.

Spot Market Activity Shows Early Strength

Bitcoin’s spot markets have recorded a modest yet notable increase in trading volume. More importantly, metrics tracking the balance between buyers and sellers have moved above key statistical thresholds, indicating a clear reduction in sell-side dominance. This shift suggests that market participants are acting with greater restraint, favoring balance over aggressive positioning.

Despite these improvements, demand has not yet reached a fully stable footing. Spot buying remains uneven, reflecting lingering caution as investors continue to assess broader macroeconomic risks. A sustained recovery in demand will likely depend on the market fully digesting external uncertainties.

Price Pullback Reflects Macro Pressures

Bitcoin recently retreated from the $95,450 level, falling nearly 3% to below $93,000. The pullback coincided with heightened risk aversion driven by renewed trade tensions between the United States and the European Union. Even so, Bitcoin remains approximately 6% higher on a year-to-date basis.

This price behavior highlights a key theme: while short-term volatility persists, the broader market structure has not deteriorated. Instead, the pullback appears more corrective than systemic.

Long-Term Bitcoin Holders Reduce Sell Pressure

One of the more meaningful shifts in recent weeks has been the behavior of long-term holders. These investors appear less inclined to sell aggressively into rallies, signaling growing confidence in medium-term market conditions. At the same time, institutional participants have continued to accumulate during periods of weakness, particularly through exchange-traded products.

Such dynamics are gradually easing sell-side pressure and contributing to a more balanced market environment.

Bitcoin’s Role Is Evolving

Against a backdrop of geopolitical uncertainty, slowing global growth signals, and record-setting gold prices, Bitcoin’s positioning within portfolios is changing. Increasingly, it is being viewed not merely as a speculative asset, but as a hedge-like instrument that can play a role in risk diversification, even as volatility remains inherent.

Liquidity Contraction and the Bigger Picture

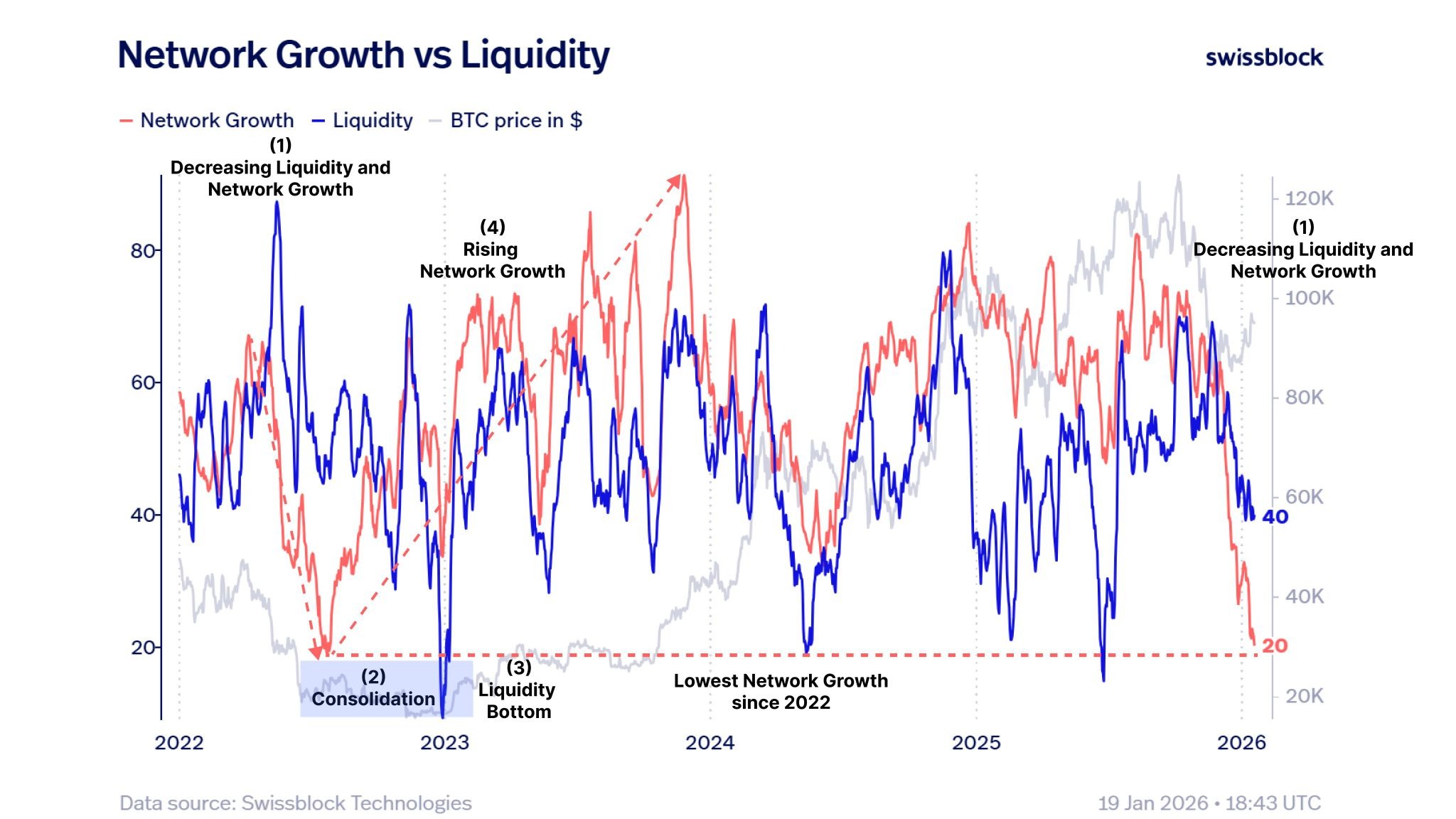

Some analysts note that the recent slowdown in network growth and tightening liquidity resemble conditions seen in past cycles. Historically, similar environments preceded extended consolidation phases that eventually gave way to stronger expansions once liquidity and network activity recovered.

In summary, Bitcoin has yet to establish a clear directional trend. However, underlying indicators suggest that the market is laying the groundwork for a more resilient and sustainable structure moving forward.

You can join our Telegram channel to not miss the news and stay informed about the crypto world.