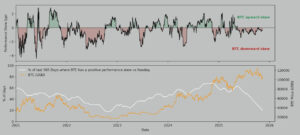

The relationship between Bitcoin and the Nasdaq 100 index has recently reached a critical threshold. BTC’s correlation with the tech-focused Nasdaq has climbed to approximately 0.80 the highest level since 2022. This indicates that Bitcoin is no longer behaving like “digital gold,” but instead is being priced more like a high-beta technology asset. What’s even more notable is that the directional quality of this correlation has deteriorated, with Bitcoin reacting more violently than equities during risk-off periods.

Historic Tightening in Bitcoin–Nasdaq Correlation

Recent data shows that the 30-day correlation between Bitcoin and the Nasdaq 100 has surged to 0.80. This confirms that Bitcoin has become far more sensitive to macroeconomic winds. The correlation had already been rising since 2020, especially after the pandemic when risk appetite increased alongside tech stocks, placing Bitcoin in the same risk category.

But the key issue isn’t just the high correlation. What matters is the quality of the correlation — Bitcoin moves in the same direction as equities, but reacts weakly to gains and excessively to losses. This “negative asymmetry” makes BTC more fragile than tech stocks during market downturns. It suggests investors increasingly view Bitcoin not as a safe haven, but as a kind of “high-risk tech bet.”

Two Major Forces Behind the Negative Asymmetry

1. Investor attention has shifted heavily toward tech stocks

Mega-cap tech companies (Nvidia, Apple, Microsoft) have drawn massive global capital inflows. In the past, rising risk appetite pushed money into crypto, but now it fuels tech stocks instead.

As a result:

When markets turn risk-off, Bitcoin still drops sharply. But when risk appetite returns, BTC lags behind tech stocks. This makes Bitcoin behave like a high-beta tech asset in downturns, without equally benefiting during upturns.

2. Liquidity in the crypto market is extremely weak

Structural liquidity issues in the crypto ecosystem have worsened recently. Weak liquidity amplifies BTC’s downside moves. $1.1 trillion in market cap has evaporated in the last 41 days. BTC has fallen 25% over the same period. With low liquidity, Bitcoin falls sharply in bad macro conditions but fails to bounce properly when conditions improve.

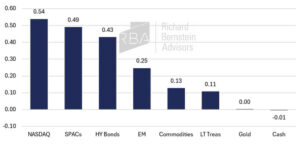

Bitcoin’s “Safe Haven” Narrative Is Being Tested

Bitcoin has long been promoted as an inflation hedge similar to gold. But the current data challenges that view.

- Gold has rallied above $4,100

- Bitcoin fell below $95,000 during the same period

- Gold–BTC correlation has dropped close to zero

This shows investors still seek gold during crises, while Bitcoin is viewed as a speculative risk asset — weakening the “digital gold” narrative.

What Happens Next Will Be Crucial for Bitcoin

Analysts say current dynamics could be temporary, or they could signal a deeper structural shift. The outcome depends heavily on:

- Whether spot ETF inflows strengthen again

- Whether stablecoin supply begins expanding

- How global liquidity evolves heading into 2025

If capital flows back into crypto, Bitcoin’s connection to the Nasdaq may weaken and the negative asymmetry could disappear. If liquidity worsens, BTC may continue trading like a tech-correlated asset for some time.

Overall Assessment

The negative turn in Bitcoin–Nasdaq correlation indicates a major shift in market perception. Bitcoin is no longer being treated as a safe-haven asset — but rather as a highly volatile, high-beta tech asset. How this dynamic evolves over the coming months will depend largely on macroeconomic liquidity and the return (or lack) of institutional capital to crypto markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.