Bitcoin has slipped to its lowest level in nearly a year, while U.S. equities are moving in the opposite direction. Strong earnings, renewed appetite for AI stocks, and improving market breadth have pushed the S&P 500 back toward record territory. At the same time, selling pressure across crypto markets has intensified.

This divergence isn’t random. Capital is rotating away from liquidity-driven trades and toward assets offering direct earnings visibility. Bitcoin falling below $65,000 fits squarely into that shift.

Stocks Recover, Crypto Pulls Back

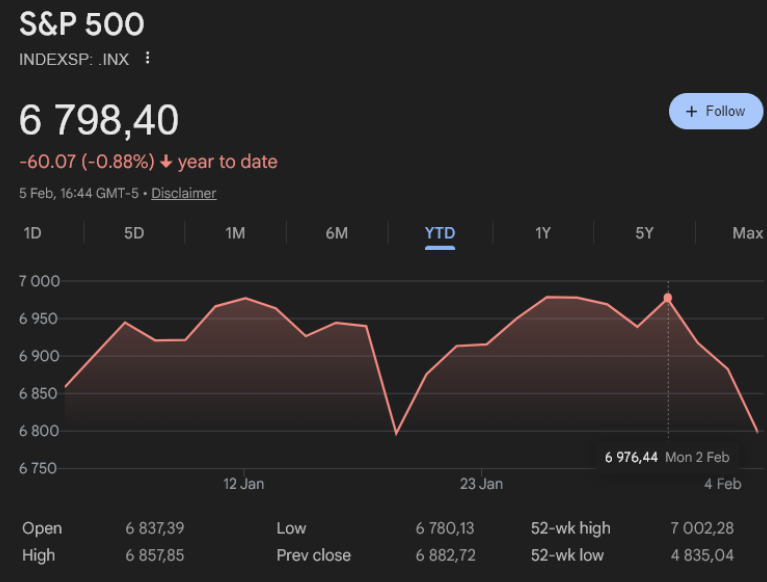

U.S. equities remain resilient despite a brief pullback after the S&P 500 climbed to around 6,976. Earlier in the week, the index closed just below its previous high before attempting another short-lived push upward.

Meanwhile, risk appetite in equities stands in sharp contrast to weakness in crypto.

Momentum on the Bitcoin side has clearly faded. As broader capital flows favor traditional risk assets, selling pressure in digital markets has become increasingly visible. The gap between sentiment toward stocks and crypto continues to widen.

Why Is Bitcoin Falling Behind?

The latest rally in the S&P 500 has been driven largely by AI-linked stocks. After a short pause sparked by valuation concerns, investors returned to big tech and semiconductors.

Alphabet hit new highs. Amazon found support ahead of earnings. Chipmakers rallied on strengthening demand expectations.

But the more interesting story is happening beneath the surface.

Market breadth has improved noticeably. Small-cap stocks have outperformed, with the Russell 2000 up roughly 3% year-to-date. Simply put, investors aren’t just betting on mega-caps anymore — confidence is spreading across the broader economy.

In short: earnings, not valuations, are now carrying the rally.

Earnings Take Center Stage

Corporate results are the primary engine behind the current advance. Analysts expect S&P 500 companies to post close to 11% earnings growth for the December quarter — well above projections from January.

FactSet data shows more than 80% of reporting firms have beaten expectations so far. Even more striking: recent research suggests roughly 84% of total S&P 500 returns in this cycle are coming directly from earnings growth. That means prices are rising because of real profits, not multiple expansion.

This shift also softens “AI bubble” fears. Cash flow, not hype, is increasingly backing higher valuations.

Macro Backdrop Remains Supportive

The broader macro picture continues to favor equities.

U.S. GDP growth is hovering around 3.3%. Inflation remains relatively contained. Productivity indicators are improving. Even temporary government disruptions and delayed data releases failed to materially shake market confidence.

The Dow Jones Industrial Average is up more than 1% year-to-date. The Nasdaq Composite is down about 2.6%, but selective buying in tech persists.

Attention now turns to upcoming economic data and the Federal Reserve’s next policy signals, as investors look for confirmation that financial conditions will stay supportive.

What Bitcoin’s Weakness Is Signaling

While stocks climb, crypto markets are moving the other way. Bitcoin dipped below $65,000, marking its weakest level in about a year. Pressure across digital assets has grown as fading momentum, declining speculative appetite, and capital rotation toward earnings-producing equities converge.

This opposing performance highlights a widening short-term split between traditional risk assets and crypto.

Both markets can benefit from liquidity expansion. But in the current environment, investors are prioritizing balance sheets over narratives.

Fresh S&P 500 highs are being powered by earnings, not valuation inflation. AI investment, relative strength in small caps, and resilient macro data continue to support the upside — even as record levels demand more selective caution.

Bitcoin’s slide to one-year lows makes one thing clear: risk appetite is weakening on the crypto side, while equities still hold the wheel.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.