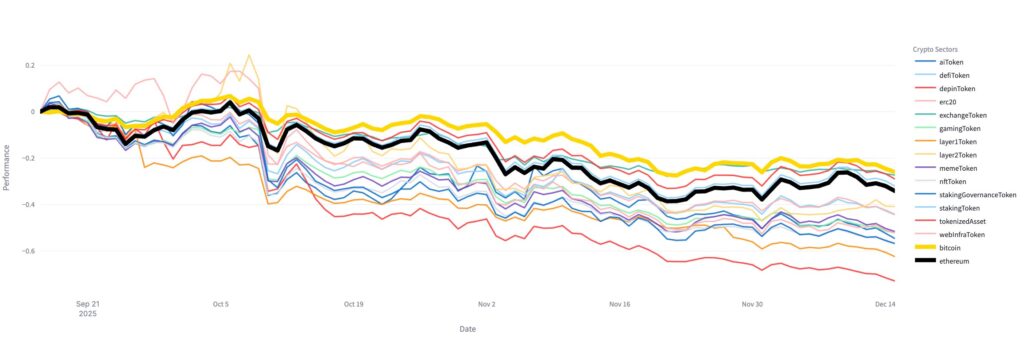

Over the past three months, Bitcoin has outperformed most other cryptocurrency sectors despite a market-wide decline. Glassnode reports show BTC dropped around 26%, while Ethereum fell 36%, AI tokens lost 48%, and memecoins sank 56%. This indicates that capital and investment continue to favor Bitcoin, highlighting its relative stability in a volatile market.

Why it matters? This trend underscores Bitcoin’s role as a safer haven, attracting investor confidence and institutional interest compared to altcoins.

Bitcoin vs Altcoins Performance

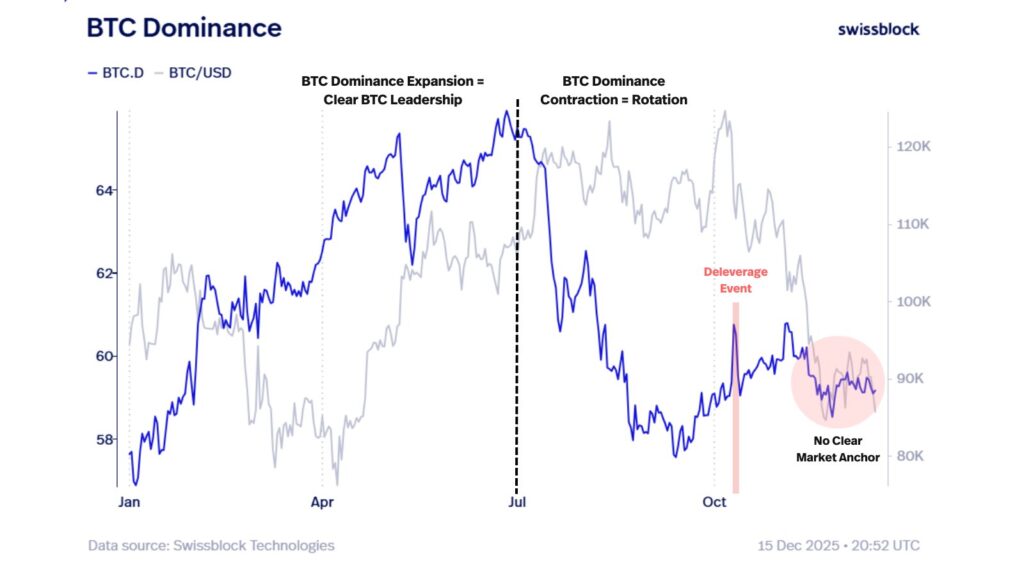

Glassnode noted that “average returns across nearly all crypto sectors have underperformed Bitcoin,” reflecting a market environment where capital concentrates on BTC. Bitcoin Vector observed that BTC dominated the first half of the year, while ETH rotation emerged later, but Bitcoin never fully regained leadership.

Ethereum, AI tokens, memes, and RWA tokens experienced steeper declines. ETH fell to $2,928, a 36% drop since mid-September. AI tokens declined 48%, memecoins 56%, and RWA tokens 46%. DeFi tokens also fell 38% over the same period. CoinMarketCap and CoinGecko data confirm these movements.

Bitcoin as a Safe Haven

Nick Ruck, director of LVRG Research, told that recent data shows capital inflows still favor Bitcoin, “reflecting strong investor preference for BTC’s stability.” He added that Bitcoin’s established reputation and growing institutional interest strengthen its appeal as a safer asset.

This trend demonstrates investor behavior leaning toward lower-risk assets, and capital concentration reinforces BTC market dominance. Overall, the past three months confirm Bitcoin’s relative strength while highlighting a market still searching for a clear leader.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.