Bitcoin fell to nearly $82,000 last week, marking a significant correction, but the market has since shown signs of stabilization. Over the weekend, the leading cryptocurrency began to recover, and analysts now believe that easing selling pressure combined with renewed expectations of a Federal Reserve (Fed) rate cut could support further upside momentum.

Selling Pressure Eases as Market Forms a Potential Bottom

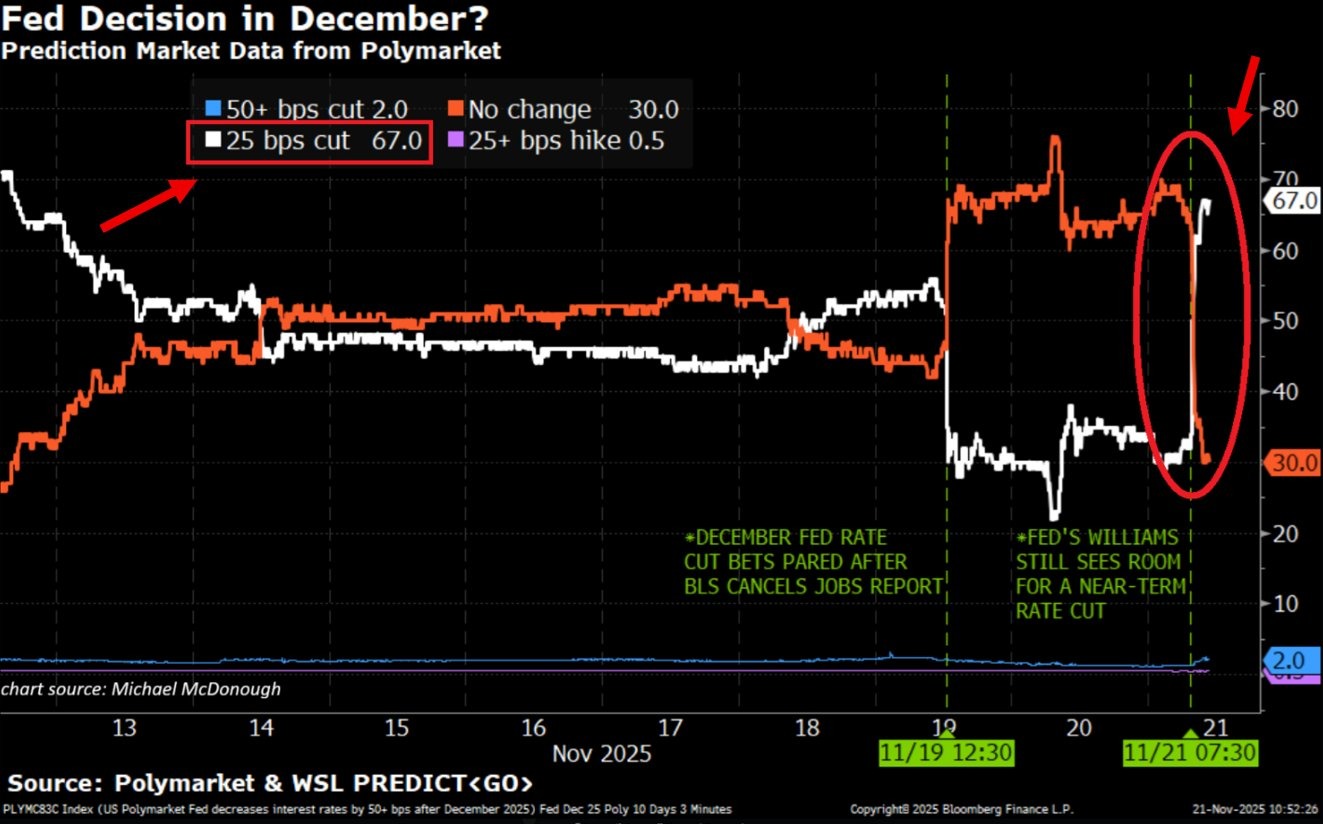

Over the past two weeks, both tech stocks and crypto assets experienced sharp pullbacks due to uncertainty surrounding interest rate expectations. Charles Edwards, founder of Capriole Fund, noted that the volatility in rate-cut forecasts has started to settle, creating conditions that could lift Bitcoin higher.

Analysts from Swissblock similarly emphasized that Bitcoin may be taking its first meaningful step toward establishing a bottom. Their assessment highlights several key points:

-

The rapid decline in the Risk-Off signal indicates that selling pressure has eased considerably.

-

The most intense phase of capitulation appears to be behind the market.

-

This week will be crucial to confirm whether the decline in selling momentum continues.

Swissblock also pointed to historical patterns, noting that major corrections often see a second, lighter wave of selling. If this secondary move fails to break previous lows, it typically serves as a reliable bottom signal and reflects a shift in control back to the bulls.

Bitcoin’s Correction Reaches 36%

According to TradingView data, Bitcoin briefly dropped to $80,600 on Coinbase on Friday, marking its lowest level since mid-April. From its all-time high above $126,000 set in early October, the decline amounted to roughly 36%. Despite this sharp move, analysts see recent price action as part of a broader consolidation phase rather than the start of a prolonged downturn.

Rate Cut Expectations Rebound Sharply

Last week, the probability of a Federal Reserve rate cut in December fell to around 30%, but changing market dynamics have driven expectations back toward 70%. Data from the CME FedWatch Tool indicates a strong likelihood of a 25 basis point cut at the Fed’s December 10 meeting.

Such expectations tend to support risk assets, and historically, rising confidence in monetary easing has been associated with renewed strength in the crypto market.

Liquidity Expansion Back in Focus

Several market analysts have also suggested that the Federal Reserve may signal new liquidity measures at its upcoming meeting, potentially under the banner of reserve management. Liquidity injections have historically been favorable for high-risk assets such as cryptocurrencies, often paving the way for strong rallies.

Some analysts argue that the Fed will eventually need to expand liquidity to maintain balance sheet stability, making such measures increasingly likely.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.