With Christmas week underway, Bitcoin investors are wondering whether the market will see a short-term move before the year comes to an end. In the final days of 2025, investors are closely watching to see whether Bitcoin will stage a sudden price surge. Declining market fear and a gradual recovery in liquidity are signaling potential opportunities for Bitcoin. Although analysts note that the overall market outlook remains mixed, they emphasize that a modest year-end increase is still possible, supported by low volatility and a renewed appetite for buying.

Low Market Fear Could Support Bitcoin

One of the positive signals for Bitcoin is the decline in market volatility and the drop in the fear index (VIX) to its lowest levels of 2025. When fear levels are low, investors tend to be more willing to take risks, which can increase short-term buying opportunities. Ben Emons, Founder and CEO of FedWatch Advisors, also believes that this environment could support a short-term rise in Bitcoin.

Ben Emons stated:

“If liquidity returns to the system toward the end of the year, Bitcoin typically performs better,”

highlighting that year-end liquidity conditions could positively influence Bitcoin’s price.

Bitcoin Trails Gold

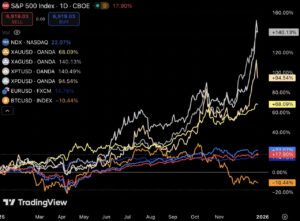

Bitcoin’s relatively muted performance in recent weeks has shifted investor attention toward gold, which has been reaching new record highs. Some analysts interpret this as a sign that Bitcoin still has recovery potential. According to FedWatch Advisors CEO Ben Emons, Bitcoin’s underperformance relative to gold could create a significant upside opportunity toward the end of the year if market sentiment improves and buying pressure increases. This perspective suggests that Bitcoin could gain value in the short term, particularly if liquidity conditions improve and investor risk appetite strengthens.

Fed Policy Will Be a Key Factor

The Federal Reserve (Fed) plays a critical role in determining the short- and medium-term direction of Bitcoin and other risk assets. While recent U.S. economic data points to strong growth, inflation remains around 2.9%, requiring the central bank to maintain a cautious approach to monetary policy. Gradual policy adjustments are expected rather than rapid rate cuts.

According to Ben Emons, there is a possibility that the Fed could implement multiple interest rate cuts by the end of 2026. Such a scenario could make Bitcoin and other risk assets more attractive to investors. If liquidity returns to the market and buying pressure increases toward year-end, investors may be able to capitalize on short-term opportunities. Emons emphasizes that this environment could support a potential rise in Bitcoin and encourage more active participation from risk-seeking investors.

Will Bitcoin Rise This Christmas?

While analysts suggest that a major breakout by Bitcoin before year-end may be unlikely, a more moderate “Santa Rally” remains on the table if liquidity improves and buying pressure returns. Low market fear levels and investors’ desire to capitalize on year-end opportunities indicate that Bitcoin could make an unexpected move in the final days of 2025. Investors are closely watching to see whether Bitcoin delivers a short-term holiday surprise, while uncertainty remains over whether the crypto market will enter the new year quietly or with renewed momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates