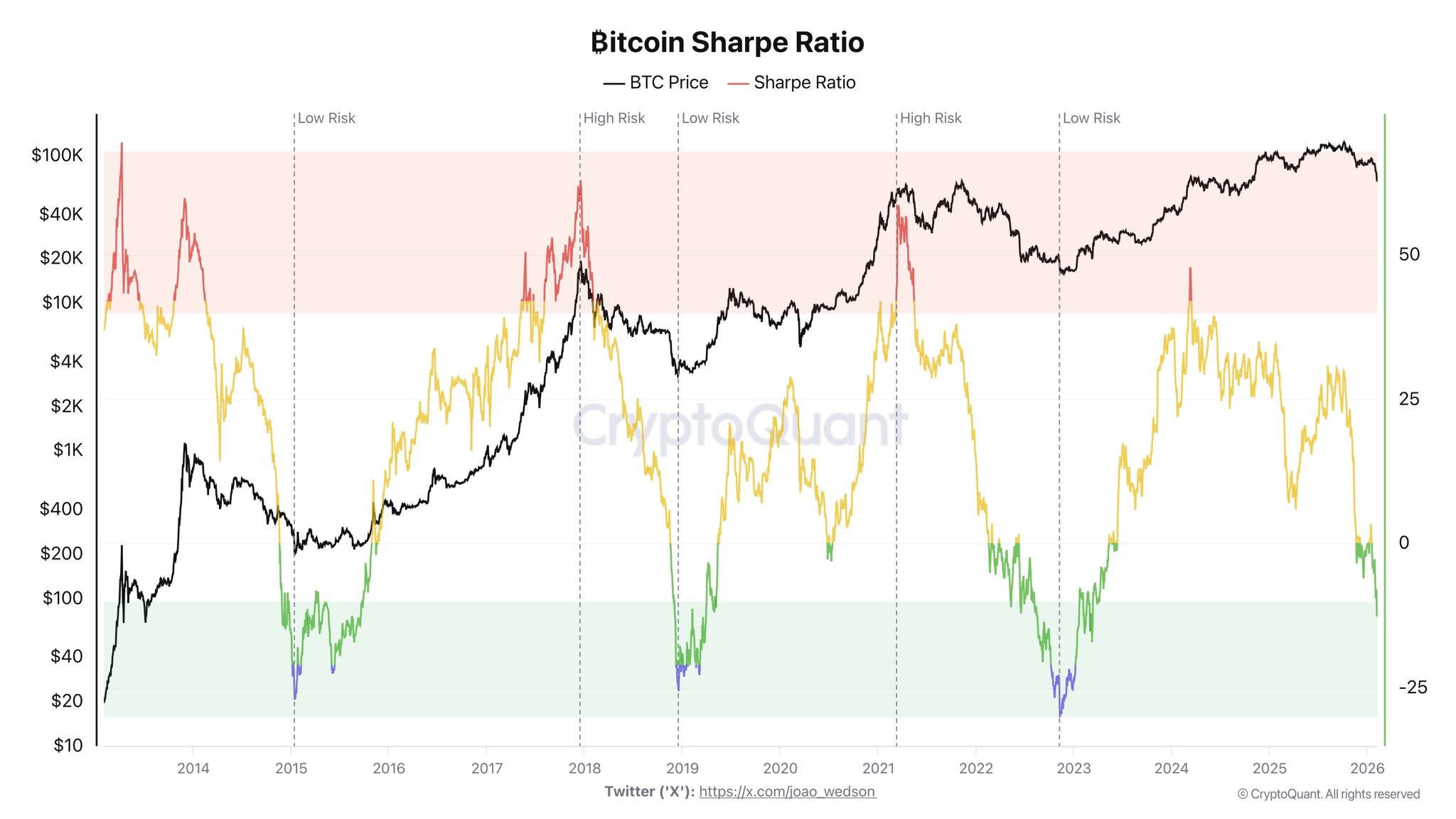

Sharp price swings in Bitcoin continue to challenge investor sentiment, while risk-based and on-chain indicators are drawing increased attention. Among these metrics, the Sharpe ratio stands out as a key measure suggesting that Bitcoin’s risk–return profile is approaching historically significant levels.

What Is the Sharpe Ratio and Why It Matters

The Sharpe ratio evaluates how much return an asset delivers relative to the risk taken to achieve it. In practical terms, it shows whether investors are being adequately compensated for volatility. A positive ratio implies a favorable balance between risk and reward, while a move into negative territory indicates that risk outweighs recent returns.

Current data shows Bitcoin’s Sharpe ratio has dropped to around -10, marking its weakest reading since March 2023. Historically, such levels have tended to appear during the most challenging phases of bear markets rather than during periods of strength.

Parallels With Previous Market Lows

When examining earlier cycles, similar Sharpe ratio readings were observed in late 2018 to early 2019 and again in late 2022 to early 2023. Both periods coincided with deep bear market troughs in Bitcoin’s price cycle, making the current situation particularly noteworthy.

More recently, the ratio moved close to neutral territory in November 2025, when Bitcoin formed a local low near $82,000. The renewed slide into deeply negative territory suggests that the risk–reward balance has once again become heavily skewed.

What a Negative Sharpe Ratio Implies

A persistently negative Sharpe ratio signals that, in the short term, Bitcoin presents a high-risk, low-return profile. Investors are taking on substantial volatility without being compensated by proportional gains. From a tactical perspective, this reinforces a cautious stance.

However, from a broader historical lens, extremely negative readings often emerge near potential turning zones. While this does not confirm the end of a bear market, it does indicate that risk conditions are reaching extremes rarely sustained over long periods.

Why a Reversal May Take Time

Despite the significance of these readings, market reversals are rarely immediate. Bitcoin could continue to consolidate or decline for several months before a decisive trend shift occurs. Without a clear macro or market catalyst, expectations for a swift recovery remain limited.

Recent price action reflects this uncertainty. Bitcoin fell to around $60,000 before rebounding to approximately $71,000, underscoring elevated volatility. Even after the rebound, the asset remains roughly 44% below its $126,000 peak, keeping overall sentiment firmly in bearish territory.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.