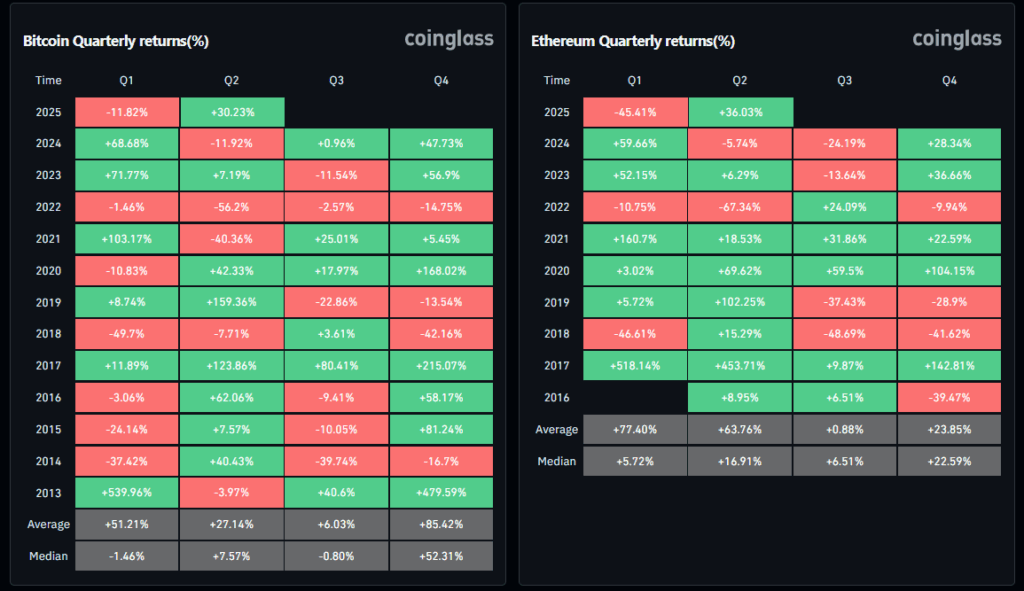

Bitcoin posted an impressive recovery in the second quarter of 2025, gaining 31.41% after a 11.82% drop at the start of the year. This rebound has helped restore confidence across the markets. Stablecoin-based indicators suggest that Bitcoin could maintain this momentum for several more months.

Joao Wedson, Founder and CEO of Alphractal, highlighted three key metrics in a post on the X platform: the Stablecoin Supply Ratio (SSR) Oscillator, the Long-Term Stablecoin Ratio Channel, and the Short-Term Stablecoin Ratio Channel. None of these indicators are currently signaling overbought conditions, providing a favorable market outlook for investors.

What Do Stablecoin Metrics Mean for Bitcoin?

Stablecoin data is becoming increasingly popular for measuring market movements. The SSR Oscillator evaluates Bitcoin’s market cap relative to stablecoin liquidity. This indicator uses the 200-day moving average and standard deviation to signal when Bitcoin is undervalued or when the market is overheated. According to Alphractal, the SSR Oscillator has yet to issue a sell signal.

3 Stablecoin Metrics That Indicate: The Bitcoin Cycle Isn’t Over! 🚀

In the cryptocurrency universe, finding reliable signals is like striking gold. At Alphractal, we’ve developed powerful oscillators that correlate Bitcoin with stablecoins, generating alpha signals that few in… pic.twitter.com/9kRPjE2V5H— Joao Wedson (@joao_wedson) June 29, 2025

The Stablecoin Ratio Channel offers two perspectives: the long-term view helps investors assess whether Bitcoin is fairly valued, supporting strategic decision-making. Meanwhile, the short-term view offers momentum-based signals through oscillation frequency, benefiting traders who operate on daily or weekly timeframes.

Wedson’s charts show multiple “buy” signals since the start of 2025, reinforcing investor optimism. Ethereum’s 37.04% increase over the same period further supports this positive outlook.

Regulatory Risks and the $2 Trillion Stablecoin Market

Despite the strong performances of Bitcoin and Ethereum, certain risks remain. Notably, regulations from major economies like the U.S. and the European Union targeting the stablecoin market could impact the broader crypto space.

However, low interest rates continue to support a favorable investment environment. The U.S. Treasury projects that the stablecoin market could soon reach a valuation of $2 trillion—highlighting its vast potential.

Both Bitcoin and the broader crypto market have shown strength in Q2 2025. As stablecoin metrics continue to emit bullish signals, investor attention is increasingly turning toward this sector.

In the comment section, you can freely share your comments about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.