According to SoSoValue data, as of November 10, U.S. Bitcoin spot ETFs recorded $1.15 million in total net inflows. The only product posting inflows was Bitwise’s BITB, which also led the day in trading volume. Ethereum ETFs, however, saw zero inflows during the same period. Meanwhile, Solana ETFs posted $6.78 million in net inflows, marking their 10th consecutive positive day. This trend indicates growing investor interest in the Solana ecosystem over recent weeks.

Bitcoin ETF Market Remains Strong

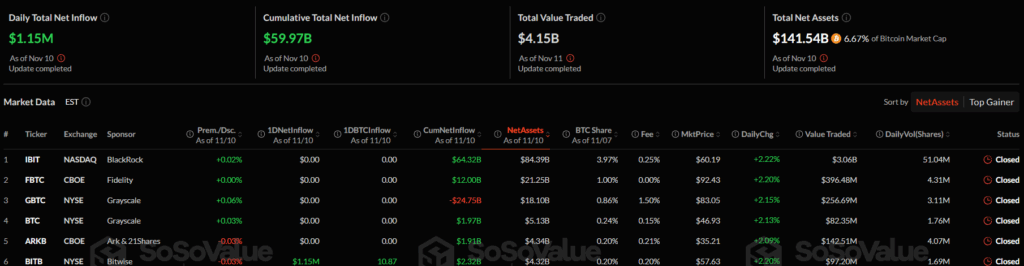

The Bitcoin ETF market continues to show strength, led by BlackRock’s IBIT fund, which holds $84.39 billion in net assets. Fidelity’s FBTC follows with $21.25 billion, while Grayscale’s GBTC maintains $18.10 billion. Bitwise’s BITB also stood out with a 2.21% daily increase.

Overall market metrics:

-

Daily total inflows: $1.15 million

-

Cumulative total inflows: $59.97 billion

-

Total trading volume: $4.15 billion

-

Total net assets: $141.54 billion

As a result, the total asset value of Bitcoin ETFs now represents 6.67% of Bitcoin’s market capitalization, underscoring strong institutional participation.

Ethereum ETFs Show No Movement

The Ethereum ETF market remained stagnant on November 10 with no net inflows recorded. BlackRock’s ETHA leads with $13.94 billion in assets, while Grayscale’s ETHE continues to show a -4.76 billion cumulative outflow. Bitwise’s ETHW fund posted a modest growth to $410 million.

Ethereum ETF overview:

-

Daily total inflows: $0

-

Cumulative total inflows: $13.86 billion

-

Total trading volume: $1.63 billion

-

Total net assets: $23.43 billion

Currently, Ethereum ETFs account for only 5.42% of the ETH market capitalization, signaling weaker inflow momentum compared to Bitcoin and Solana products.

Solana ETFs Extend 10-Day Inflow Streak

Solana ETFs have continued their consistent inflow streak since the beginning of November, reinforcing investor confidence in the asset. As of November 10, the funds registered $6.78 million in net inflows, supporting a clear upward trend. The rising activity within the Solana DeFi and tokenization ecosystem has also contributed to this sustained momentum.

Market Outlook

While Bitcoin ETFs remain a strong indicator of institutional confidence, the steady performance of Solana ETFs highlights a shift in attention toward alternative Layer-1 networks. In contrast, Ethereum’s lack of inflows suggests that short-term investors may currently be favoring Bitcoin and Solana for better yield optimization.

Overall, the latest data clearly illustrates which digital assets are attracting the most ETF-driven institutional interest in the 2025 crypto market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.