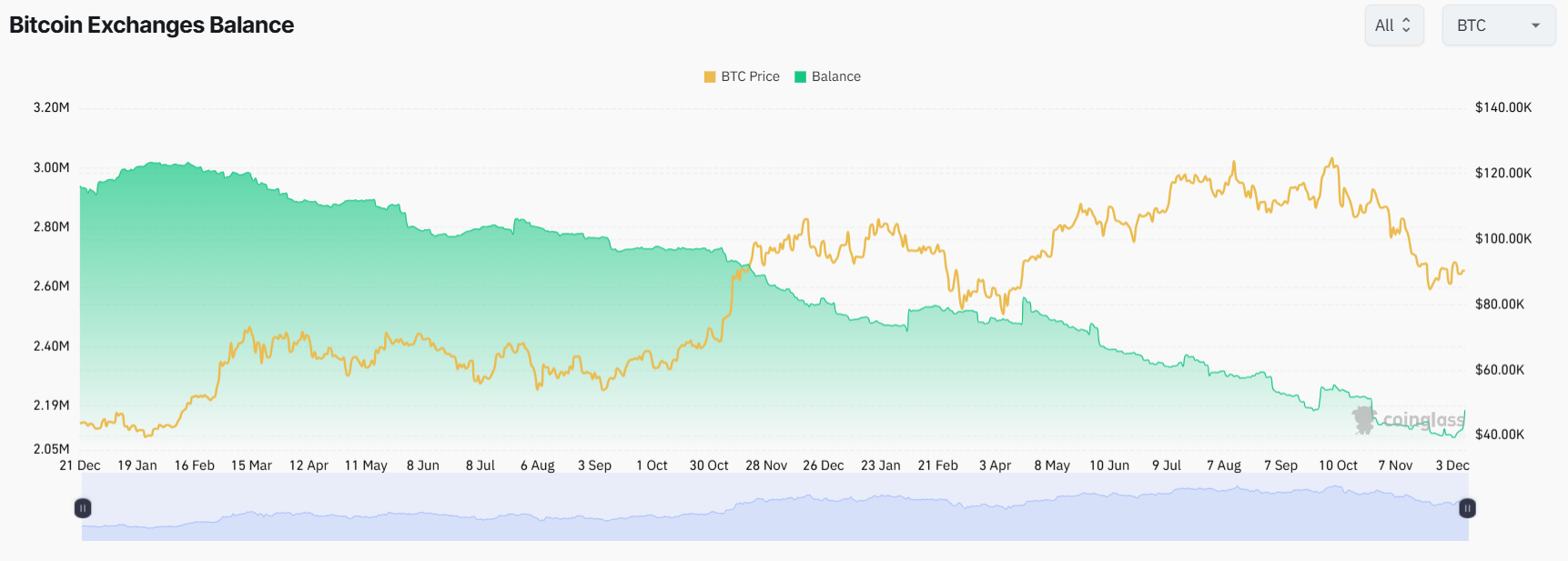

Exchange reserves are one of the most important indicators for understanding long-term trends in the crypto market. Recent data shows a striking development for Bitcoin: exchange-held BTC has dropped sharply over the past year. This shift signals tightening supply conditions and a growing tendency among investors to hold their assets for the long term rather than trade them actively.

A declining exchange balance historically reduces immediate selling pressure and often sets the foundation for stronger price movements when demand increases.

Over 400,000 BTC Withdrawn From Exchanges in One Year

Since December 2024, more than 403,000 Bitcoin have been withdrawn from centralized exchanges. This amount represents roughly 2% of Bitcoin’s total circulating supply. A significant share of these coins has moved into personal cold wallets and long-term storage addresses.

Such behavior typically reflects investor confidence and a reduced appetite for short-term selling. At the same time, Bitcoin has been trading near the $90,000 level, making the continued outflow even more notable. Historically, periods where exchange balances fall during high price levels often coincide with reduced downside risk.

Institutional Accumulation Is Gaining Momentum

Not all Bitcoin leaving exchanges is heading into private wallets. A substantial portion is being absorbed by institutional players, particularly exchange-traded funds and publicly listed companies. These entities have steadily increased their Bitcoin holdings over recent months.

Current figures show that ETFs now control more than 1.5 million BTC, while public companies hold over 1 million BTC. Together, these institutional wallets now contain more Bitcoin than all exchanges combined. This marks a structural shift in the market, where long-term capital is becoming more influential than short-term speculative trading.

What a Tightening Supply Means for Price Dynamics

As of late November, the total Bitcoin balance held on exchanges stands near 2.11 million BTC. When compared with institutional holdings, roughly 11% of the total Bitcoin supply is now locked within ETFs and corporate treasuries.

This tightening of liquid supply has major implications for future price behavior. With fewer coins readily available for trading, any surge in demand could trigger faster and sharper upward price movements. The ongoing reduction in exchange reserves suggests that supply-side pressure is building quietly in the background.

If demand continues to grow while accessible supply remains constrained, Bitcoin’s long-term price dynamics could become increasingly sensitive to new inflows of capital.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.