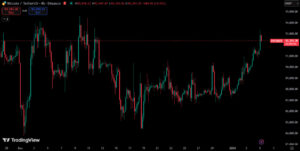

Bitcoin drew attention on Sunday night by climbing above the $93,000 level amid a broad-based rally in the cryptocurrency market. According to analysts, this move came as investors were digesting news of U.S. military operations in Venezuela and reassessing global risk sentiment. Ethereum and other major cryptocurrencies also joined the rally.

Bitcoin and Major Cryptocurrencies Rise

Late Sunday night (local time), Bitcoin was trading around $92,400 and gained roughly 2.1% over the past 24 hours. Ethereum rose 1.7% to $3,194. Altcoins also showed strength: XRP surged 5.5%, BNB increased 2.3%, and Solana climbed 2.3%. Analysts note that this move was not limited to crypto alone, but part of a broader “everything rally” seen across global markets.

Support From Asian Markets

According to Presto Research analyst Min Jung, the rally in crypto markets has been moving in tandem with strong performance in Asian equities. South Korea’s Kospi index rose 2.83%, while Japan’s Nikkei index gained 2.82%.

Jung commented:

“In the first week of the new year, investors often establish new positions, and Bitcoin is being viewed as an attractive entry point at current levels. At the same time, geopolitical developments remain a key source of potential volatility in global markets.”

Liquidations Surge, Shorts Take the Hit

The sharp rise triggered significant activity in derivatives markets as well. Data from Coinglass shows that approximately $263.44 million in liquidations occurred over the past 24 hours, with $197.43 million coming from short positions. This suggests that the rally was largely fueled by short squeezes.

Venezuela Developments at the Center of Attention

Jeff Ko, Chief Analyst at CoinEx Research, noted that market participants are closely watching developments related to U.S. military operations in Venezuela. According to U.S. media reports, deposed leader Nicolás Maduro was taken to the U.S. following an operation in Caracas, bringing geopolitical risk back into focus. After the news, U.S. WTI crude oil slipped 0.35% and Brent crude fell 0.2%. Analysts say that with traditional markets closed over the weekend, crypto markets became the most liquid venue to price in these developments.

Ko added:

“The opening of U.S. equity markets will be critical. A positive open could support Bitcoin holding above the $92,000 level.”

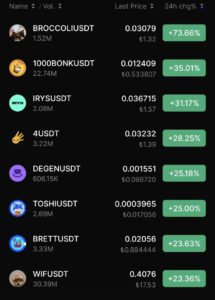

Strong Moves in the Memecoin Market

Alongside major cryptocurrencies, the memecoin sector also saw increased momentum. Shiba Inu gained 5.5%, Pepe jumped 9%, and Bonk rose 9.7%, reflecting broader market optimism. Dogecoin diverged from the trend, posting a modest 0.6% decline. This suggests that short-term investor interest has shifted toward memecoins with higher perceived upside potential.

Key Levels Ahead for Bitcoin

Bitcoin’s move above $93,000 highlights the combined impact of geopolitical developments, global risk appetite, and short-position liquidations. Analysts say the $95,000 level will be an important resistance area to watch in the coming days. The direction of U.S. equities, expectations around Federal Reserve policy, and upcoming macroeconomic data will play a key role in determining whether Bitcoin can sustain its upward momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.