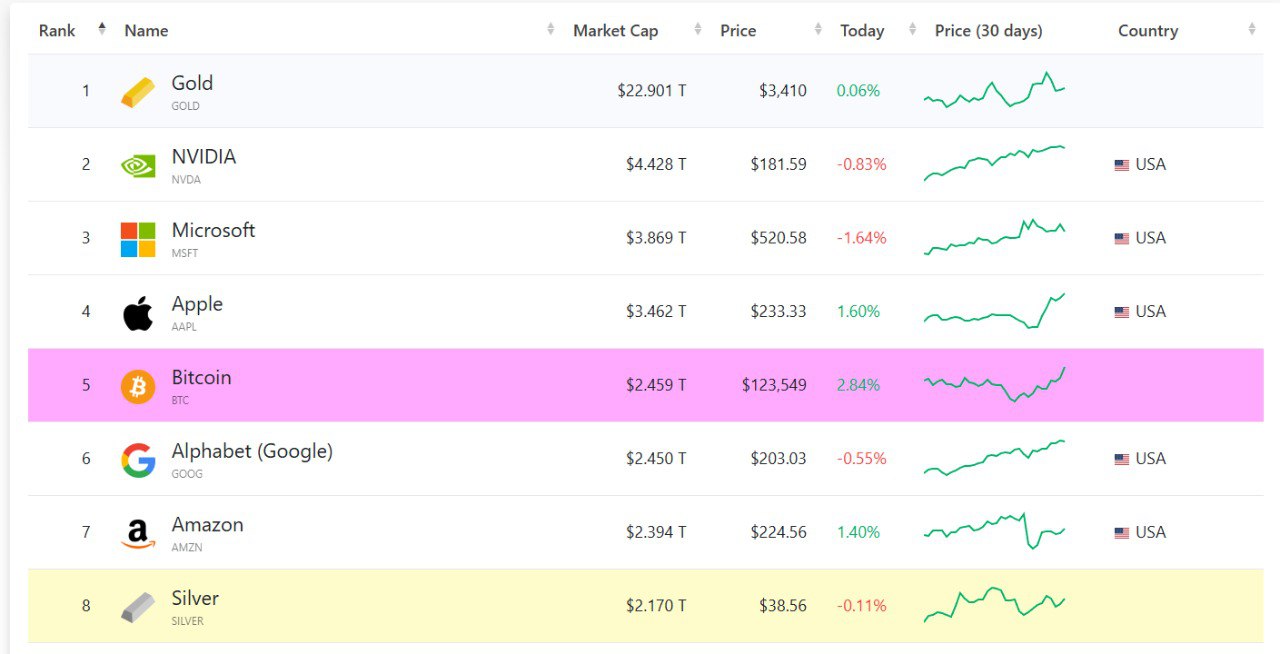

Bitcoin has overtaken Google in market capitalization, becoming the fifth-largest asset in the world. This major milestone reflects a year-long bullish trend shaped by a friendlier regulatory environment under President Donald Trump and the rapid adoption of corporate treasury strategies focused on bitcoin accumulation.

Record-Breaking Rally

On Wednesday, BTC broke its previous all-time high, moving in tandem with U.S. stock market gains. In Asian trading, the price climbed above $124,000, surpassing the July 14 peak of $123,205 before a brief round of profit-taking. On the same day, the S&P 500 index also recorded its second consecutive all-time high, showing that both equities and crypto assets are benefiting from the same positive macro backdrop.

With this rally, bitcoin’s market cap has reached $2.46 trillion, overtaking Google’s $2.4 trillion valuation. Ethereum remains the second-largest cryptocurrency, with a market capitalization of around $575 billion.3

Corporate Bitcoin and Ethereum Treasury Strategies

Led by Michael Saylor, MicroStrategy pioneered the strategy of adding bitcoin to corporate balance sheets. This approach is now being adopted by smaller publicly traded companies, while Ethereum advocates are also starting to follow suit.

Macro Factors and Technical Outlook

U.S. inflation data came in line with expectations, boosting market bets that the Federal Reserve will cut interest rates in September. Lower borrowing costs tend to increase demand for risk assets, positively impacting the crypto market.

Technical analysts note that if bitcoin can hold above the $120,000 level, the next upside target could be in the $135,000–$138,000 range.

This content is strictly for informational purposes and does not constitute investment advice. Markets involve high risk, and you should conduct your own research before making any investment decisions.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.