A newly released analysis from Galaxy Research suggests that companies holding substantial Bitcoin treasuries are now entering a decisive “Darwinian phase.” According to the report, the core mechanisms that once fueled the rapid expansion of digital asset treasury (DAT) firms are breaking down. Leverage, which previously served as a major advantage during bullish periods, has now turned into a significant source of downside pressure.

This structural shift emerged as Bitcoin fell sharply from its early October peak near $126,000 to levels around $80,000. The move triggered a steep decline in risk appetite and siphoned liquidity out of the broader crypto market. The widespread deleveraging event on October 10 intensified the trend, erasing open interest across futures markets and weakening spot liquidity.

From Premiums to Discounts: DAT Equities Enter a New Era

Throughout the summer, many DAT companies traded at substantial premiums to their net asset value (NAV). That dynamic has now reversed. Despite Bitcoin being down only about 30% from its highs, most treasury-focused firms have seen significantly larger declines in their equity prices.

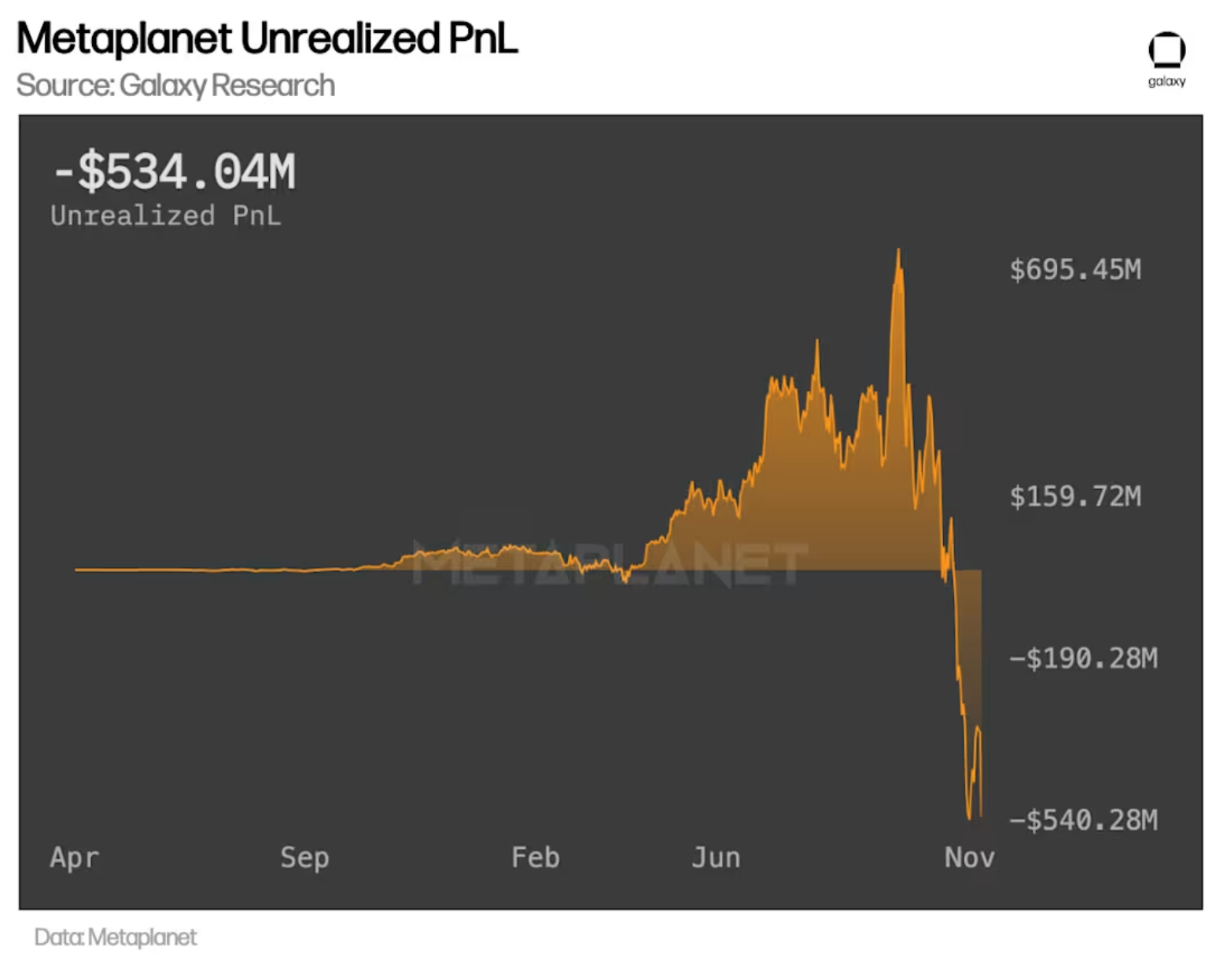

Companies such as Metaplanet and Nakamoto, which once showcased hundreds of millions in unrealized profits, are now facing substantial losses, as their average Bitcoin acquisition cost sits above $107,000. Galaxy points out that the collapse has been especially severe for NAKA, whose share price has dropped more than 98% from its peak — a drawdown the firm likens to the dramatic wipeouts seen in memecoin markets.

Three Scenarios That Could Define the Road Ahead

With the issuance window closing, Galaxy outlines three potential outcomes for DAT firms going forward:

Extended compression: A prolonged period in which equity premiums remain subdued, BTC-per-share growth stalls and DAT stocks carry greater downside risk than holding Bitcoin directly.

Consolidation: Firms that aggressively issued shares at high premiums, accumulated Bitcoin near cycle tops or took on excessive debt may face solvency challenges, potentially leading to acquisitions or restructuring.

Selective recovery: A rebound remains possible if Bitcoin reaches new all-time highs, but only for companies that preserved liquidity and avoided overleveraging during the expansion phase.

Strategy Bolsters Reserves as Dividend Concerns Rise

In response to mounting investor concern, Strategy CEO Phong Le announced the creation of a $1.44 billion cash reserve. Funded through an equity sale, the reserve aims to secure the company’s dividend and debt commitments for at least 12 months, with plans to extend this safety buffer to 24 months.

Meanwhile, Bitwise CIO Matt Hougan emphasized that Strategy would not be forced to sell Bitcoin even if its share price declines, calling contrary claims “flat-out wrong.”

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.