As Bitcoin (BTC) moves towards $100,000, investors prefer holding onto their coins instead of depositing them into exchanges. However, BTC needs to break through key resistance levels before initiating a sustainable bull run.

Bitcoin Investment Addresses Decline

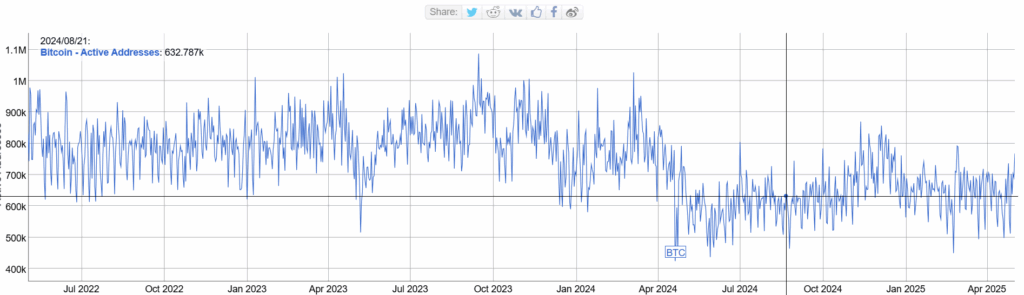

In a Quicktake analysis published on the CryptoQuant platform, CryptoOnchain highlighted a decrease in the number of Bitcoin wallet addresses sending funds to centralized exchanges. According to the data, the number of addresses depositing BTC to exchanges has dropped to its lowest level since 2017. This indicates that spot investors are choosing to hold their Bitcoin rather than sell, signaling expectations of a near-term price increase.

BTC Tests $97,000

BTC surpassed $97,000, reaching its highest level since February 20. BTC is supported by expectations of a potential U.S. Federal Reserve (Fed) interest rate cut. Lower interest rates reduce bond yields, boosting interest in riskier assets like BTC. Investors are turning to cryptocurrencies and stocks in pursuit of higher returns.

Crypto analyst PlanB noted that the next critical resistance level for BTC is around $97,530. Bitcoin is currently trading slightly above $97,000. A clear close above $97,500 could strengthen the likelihood of Bitcoin reaching a new all-time high (ATH) in the near term. As a reminder, Bitcoin’s current ATH is $108,786, recorded on January 20.

Crypto analyst Doctor Profit suggested that Bitcoin’s local bottom for this cycle may have been $74,508, seen on April 6. The current price is only 11.3% below the ATH. The analyst noted that BTC has formed a strong monthly bullish candle and is trading above the Ichimoku Cloud indicators, which present a positive outlook for BTC.

Additionally, analyst Credible Crypto, based on the Golden Ratio Multiplier model, predicted that Bitcoin could reach $124,000. As of writing, Bitcoin is trading around $97,000, up 3.3% in the last 24 hours.

BTC Signals Strong Bullish Momentum

Backed by technical indicators and macroeconomic developments, BTC is flashing strong bullish signals. The decline in addresses depositing to exchanges shows that investors are opting to hold rather than sell. However, breaking the $97,500 resistance remains critical for a new ATH.

—This is not investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.