The cryptocurrency markets experienced an extremely volatile period throughout 2025, shaped by record-breaking rallies and sharp sell-offs. Bitcoin (BTC) stood at the very center of this turbulence, reaching a new all-time high during the year while also suffering major pullbacks driven by massive liquidations. This outlook suggests that Bitcoin is at risk of ending the year with a loss for the first time since 2022.

Bitcoin’s 2025 Turbulence: Record Highs and Shocking Crashes Together

In the first half of the year, the election of crypto-friendly U.S. President Donald Trump gave Bitcoin strong upward momentum. Riding this wave, BTC surpassed $126,000 in early October, setting a new ATH.

However:

- The new customs tariffs announced in April,

- Trump’s harsh tariff announcement on Chinese imports on October 10,

- The domino-effect liquidation of highly leveraged positions

triggered historic declines in Bitcoin. The liquidation exceeding $19 billion became the largest in crypto history. In November, BTC experienced its sharpest monthly drop since mid-2021, and investor sentiment deteriorated significantly.

Year-End Scenario: Will BTC Close Below $80,000?

Investor expectations for the year-end price continue to weaken.

- BTC’s probability of closing the year below $80,000 is currently priced at 32%.

- This ratio was around 40% a few weeks ago, meaning the bearish scenario has weakened slightly but still carries significant risk.

This outlook is discouraging for major institutional players such as Michael Saylor and Strategy, who previously projected a rise toward $150,000.

Bitcoin Now More Sensitive to Macro Developments

In 2025, the correlation between Bitcoin and equities increased significantly:

- BTC – S&P 500 correlation: 0.50

- BTC – Nasdaq 100 correlation: 0.52

These figures show that Bitcoin is now much more vulnerable to traditional market fluctuations. In particular, movements in AI-related stocks have been progressing in sync with crypto markets.

Analysts attribute this to:

- Growing participation of traditional funds in crypto

- Bitcoin being increasingly viewed as a “risk asset” by a broader investor base

- Macro sentiment influencing both markets in similar ways

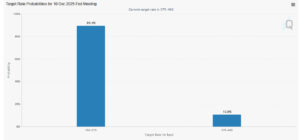

Eyes on the FED: Interest Rate Signals Will Set the Direction

The interest rate decision from the U.S. Federal Reserve this week is seen as a critical turning point for markets. A 25 bps rate cut is currently priced in at 89% probability. The statements made following the decision hold the potential to directly influence Bitcoin’s short-term direction.

As the year enters its final weeks, analysts emphasize that expectations for rate cuts, developments in the AI sector, and changes in global risk appetite will be decisive in Bitcoin’s trajectory. Together, these factors represent some of the most important indicators for where the crypto markets may move in the coming days.

Overall Assessment

For Bitcoin, 2025 has become a year that practically tested the market’s resilience. Although the year began with record highs, repeated interruptions came from political announcements, customs tariffs, macroeconomic uncertainties, and increased regulatory pressure. As a result, the market experienced both a strong bull rally and severe pullbacks in the same period.

At the current stage, the picture is still far from fully recovered. The increasing sensitivity to macro developments, volatility-driven behavior of leveraged positions, and fluctuations in investor confidence keep the risk of Bitcoin ending the year in negative territory alive. According to analysts, this risk is low but not entirely eliminated meaning Bitcoin’s year-end performance still carries a critical level of uncertainty.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.