The cryptocurrency market is witnessing one of the largest and most remarkable whale movements in recent years. A Bitcoin OG, who had been holding assets for seven years, has started gradually converting the 100,784 BTC purchased in 2018 into Ethereum.

This move not only shook Bitcoin prices but also highlighted Ethereum’s rising value among institutional investors.

End of a 7-Year HODL Period

The whale had bought 100,784 BTC in 2018 for just $642 million, when the average price was around $6,370. Today, the same amount is worth $11.4 billion.

The reactivation of this long-dormant wallet caught investors’ attention, as such large transactions usually signal either a new market trend or significant price volatility.

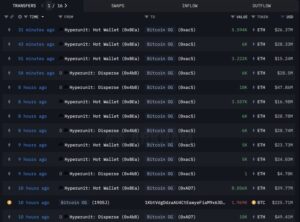

Massive BTC Transfers to Hyperliquid

Over the past five days, approximately 22,769 BTC ($2.59 billion) were deposited into the decentralized derivatives platform Hyperliquid. These transfers indicate that the whale is preparing to sell.

Decentralized platforms like Hyperliquid allow high-volume, institutional-scale investors to trade in a more transparent and secure manner. The whale’s choice of this platform proves that alternatives outside traditional exchanges are becoming increasingly attractive to large players.

Shift Toward Ethereum

The proceeds from BTC sales were quickly directed to Ethereum:

- 472,920 ETH ($2.22 billion) purchased on the spot market

- An additional 135,265 ETH ($577 million) used to open long positions

This shows that the whale is not only engaging in short-term trading but also believes in Ethereum’s long-term value.

Previous Sales and Ongoing Strategy

These aggressive moves are part of a broader ongoing strategy. In recent weeks, the whale had sold more than 24,000 BTC. Most of the proceeds were again converted to Ethereum:

- $2 billion worth of ETH purchased

- $1.3 billion worth of ETH staked

This also shows that the investor aims to benefit not only from ETH price movements but also from Ethereum’s staking yields.

Market Impact

Sales of this scale naturally caused significant market fluctuations. In particular:

- Bitcoin’s price experienced sharp short-term declines.

- $310 million worth of long positions were liquidated.

- Volatility in the crypto markets reached record levels.

Ethereum’s Rising Star Status

This whale’s choice proves that Ethereum is increasingly becoming a strong institutional investment asset. Ethereum 2.0 updates, its staking model, and growing institutional adoption make ETH attractive.

Trading volumes in both spot and derivatives markets show that Ethereum is no longer merely “an alternative to Bitcoin” but has assumed a leadership role on its own.

This situation increases selling pressure on Bitcoin while highlighting growing institutional confidence in Ethereum. In the coming days, whether the whale sells the remaining 6,000 BTC (approximately $670 million) will be critical for the market’s direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.