As the crypto market faces intensified selling pressure this week, on-chain data highlights a striking divergence in investor behavior. While Bitcoin briefly dipped below $90,000, smaller holders have been reducing their exposure, whereas large wallets have quietly shifted back into accumulation.

Whale Wallets See Strong Recovery Since Late October

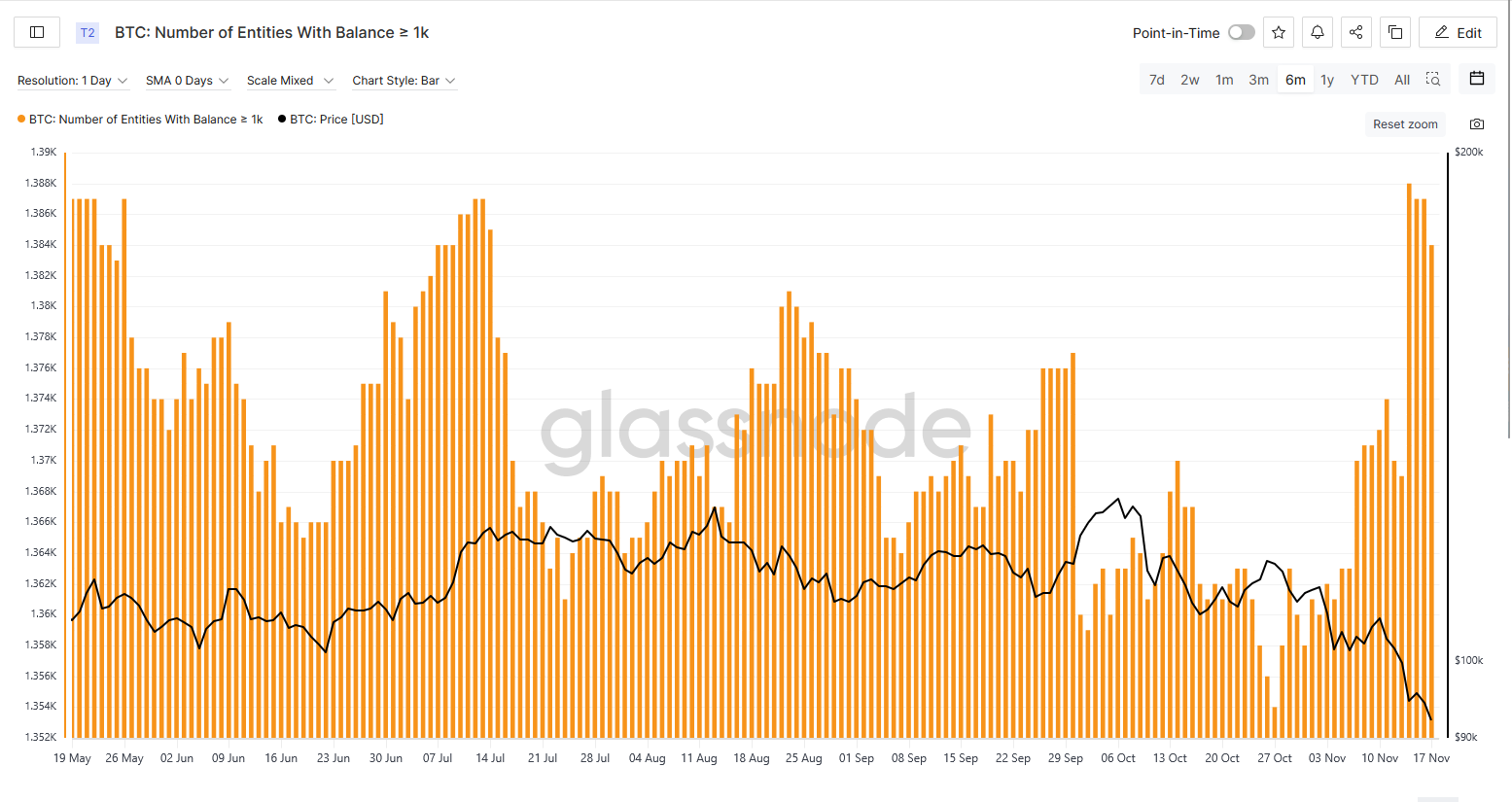

According to data from Glassnode, Bitcoin whales resumed accumulation despite the downturn that began in late October. Addresses holding more than 1,000 BTC showed particularly strong growth starting last Friday.

The number of large whale wallets had fallen to a yearly low of 1,354 on Oct. 27, at a time when Bitcoin traded near $114,000. However, by Nov. 18, this figure had climbed 2.2% to reach 1,384 — the highest level observed in the past four months.

Mounting Pressure on Smaller Bitcoin Investors

The trend among smaller holders has moved in the opposite direction. Wallets holding at least 1 BTC declined from 980,577 on Oct. 27 to a yearly low of 977,420 on Nov. 17.

This pattern reinforces a familiar theme in crypto markets: during sharp declines, retail investors tend to panic-sell, while larger entities often take advantage of lower prices. It also challenges the recent narrative suggesting that long-term early investors have been the primary source of selling pressure.

FOMC Impact and Shifts Among Major Cohorts

Markus Thielen of 10X Research notes that selling among large holders has not completely subsided. He points to the U.S. Federal Reserve’s Oct. 29 meeting as a turning point, arguing that it disrupted the temporary balance between aggressive sellers and accumulating whales.

While some large-scale wallets continue offloading coins, medium-sized whales—those holding between 100 and 1,000 BTC—have absorbed a significant portion of this supply. Even so, the 30-day net flow data shows that selling remains dominant across these groups.

Bitcoin Breaks Below $90K as Fear Intensifies

Bitcoin slipped back below the key psychological level early this week and is currently trading near $89,900. The downturn pushed the Crypto Fear & Greed Index down to 11 out of 100, placing the market firmly in the “extreme fear” zone.

Despite this, executives at Bitwise and BitMine expect selling pressure to ease soon and argue that Bitcoin may be nearing a bottom. Bitwise CIO Matt Hougan describes current prices as a “generational opportunity” for long-term investors.

Analysts Expect a Potential Bounce Soon

Several market commentators on X share a similarly optimistic outlook, suggesting that Bitcoin could soon stage a rebound. Some anticipate the price briefly touching the $87,700 support area before a stronger reaction occurs.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.