Attention in the crypto market has once again shifted to Bitcoin’s (BTC) order book data. Analysts report that BTC’s buy-sell ratio has turned positive for the first time in months a sign that upward momentum may be returning. Data shows that buying interest across major exchanges is now outweighing selling pressure, hinting at a potential trend reversal in price direction.

Buy Pressure Returns to Bitcoin Order Books

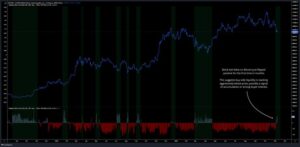

Following recent volatility, Bitcoin continues to consolidate around $100,000, but a new trend in order book activity indicates an important shift in market dynamics. According to CryptoQuant analyst Maartunn, Bitcoin’s Buy-Sell Ratio rose to +0.2, entering positive territory for the first time in months. This marks the first “green reading” after a prolonged period of negative sentiment. A positive ratio means that buy-side liquidity now dominates sell orders, suggesting that investors are moving from selling to accumulation mode.

What Is the Buy-Sell Ratio?

This metric helps investors gauge market sentiment by comparing buy orders (bids) to sell orders (asks) on exchanges:

- Positive values (+) → Buying interest exceeds selling pressure

- Negative values (-) → Selling dominates

- Zero (0) → Market is balanced

For instance, a +0.2 ratio means that roughly 60% of liquidity is concentrated on the buy side, compared to 40% on the sell side. Analysts note that readings above +0.2 often precede bullish trend reversals.

Buy Walls Are Reappearing

CryptoQuant data reveals that buy walls clusters of passive buy orders placed by whales and institutional market makers are forming again across major exchanges. While previous months saw heavy sell-side dominance, recent data shows a clear resurgence of buying activity.

Analyst Maartunn commented:

“This indicates that investors are switching from aggressive market selling to buying dips. Such accumulation behavior in order books often occurs just before a price recovery begins.”

What Does This Mean for Bitcoin’s Price?

The shift to a positive buy-sell ratio suggests that demand pressure is once again outweighing supply. For investors, this implies two key takeaways:

- Short-term price stability could improve.

- Medium-term bullish potential is strengthening.

If Bitcoin holds the $100,000 support, analysts expect the next key target to be $110,000. Should the ratio remain positive for several weeks, BTC could enter a new bullish phase. Notably, on-chain strategist PlanB predicts that, if the current structure holds, Bitcoin may rise toward $130,000 in the coming months.

Market Sentiment Turns Optimistic

After months of weak demand, Bitcoin’s order books now show a clear shift in balance. Increasing limit orders, reformed buy walls, and a sustained positive ratio point to improving investor confidence. If this trend continues, analysts believe Bitcoin could be on the verge of entering a strong upward phase in the medium term signaling that accumulation is quietly replacing fear in the market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.