In the cryptocurrency market, the Bitcoin Layer-2 infrastructure project Bitlight ($LIGHT) has drawn investor attention after experiencing a dramatic decline in a short period of time. According to CoinGecko data, $LIGHT fell sharply from its peak of $4.6995 to $0.855, and is currently trading at around $0.9572. This sudden drop has had a significant impact on investor psychology while also directly affecting market liquidity and capital flows.

Analysts emphasize that sudden price movements are common in highly volatile Layer-2 projects like $LIGHT, and that investors should remain cautious about short-term fluctuations. Market observers note that such dramatic declines not only affect price levels but also significantly influence investor confidence and overall market sentiment.

Peak and Rapid Decline in LIGHT

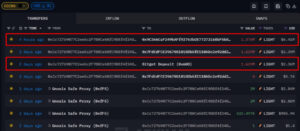

The decline in $LIGHT is also supported by on-chain data:

- $6.4 million worth of $LIGHT was transferred from a team-funded wallet to Bitget.

- Two days earlier, $2.4 million was sent from the same wallet.

- Another wallet holds an additional $2.4 million prepared for potential future sales.

These transactions caused the price to fall from $4.6 to $0.85 within hours. Investors using excessive leverage were liquidated, and each sell-off accelerated the price decline. Additionally, every small price rebound was used as an opportunity for further selling, while brief pauses were exploited to conceal team sales.

Market Impact and Investor Reactions

Crypto analysts state that Bitlight ($LIGHT)’s sudden crash created panic and uncertainty in the market. Short-term investors, in particular, suffered significant losses due to excessive leverage, making the market temporarily vulnerable to volatility. Experts stress that such sharp declines are not limited to price action alone, but are closely linked to factors such as liquidity, capital flows, and team sell-offs. Moreover, the rapid erosion of investor confidence and increasing psychological pressure can trigger a domino effect across the market. For this reason, analysts advise crypto investors to act cautiously during large buy and sell transactions, especially in Layer-2 projects.

Expert Opinion

In expert commentary, it was stated: “In Layer-2 projects like Bitlight, sudden price drops are often quickly triggered by team sales and high volatility. Investors should focus on risk management rather than chasing short-term opportunities.” Analysts add that large sell-offs and liquidity movements can push prices down in a very short time, negatively impacting investor psychology.

It is also emphasized that such abrupt declines in Layer-2 projects necessitate a more cautious approach in portfolio diversification and long-term investment strategies. This highlights once again the importance of strategic and informed decision-making over impulsive actions when dealing with highly volatile crypto assets.

Assessment

Bitlight ($LIGHT) briefly fell below the $1 mark following this morning’s sharp decline. Currently trading at around $0.9572, $LIGHT stands out as an asset that requires close monitoring due to its high volatility. Crypto investors should remain cautious about sudden liquidity shifts, particularly in Layer-2 projects, and prioritize risk management when diversifying their portfolios.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.