BitMine Immersion Technologies, the world’s largest corporate Ethereum holder, continues to expand its ETH holdings despite short-term price decline expectations. Over the past two days, the company purchased a total of $199 million worth of Ether.

BitMine Continues Ether Accumulation

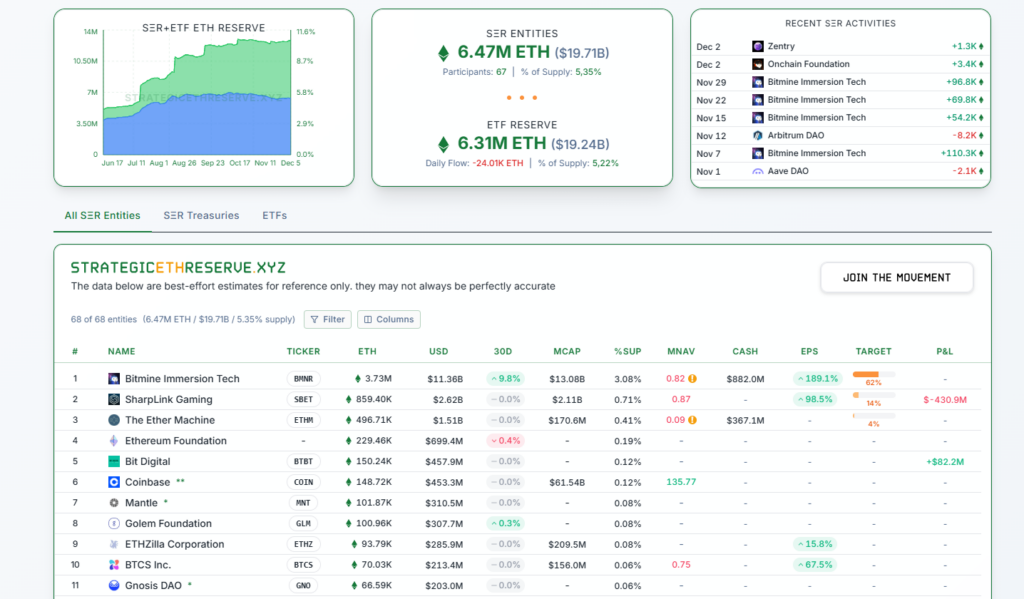

According to blockchain analytics platform Lookonchain, BitMine acquired $130.7 million in Ether on Friday and an additional $68 million on Saturday. With these recent purchases, the company now holds $11.3 billion in ETH, representing 3.08% of the total ETH supply and moving closer to its 5% accumulation target. BitMine also maintains $882 million in cash reserves, which could be used for future acquisitions.

Corporate Ether purchases have slowed in recent months, yet BitMine captured a significant share. While total Ethereum acquisitions fell from 1.97 million in August to just 370,000 in November, BitMine alone accumulated 679,000 Ether, equivalent to $2.13 billion. This underlines the company’s strong confidence in Ethereum’s long-term growth potential.

Smart Money Traders Bet on Short-Term Decline

According to blockchain intelligence platform Nansen, the industry’s highest-performing investors, known as “smart money” traders, are betting on short-term Ethereum price drops. Over the past 24 hours, these traders added $2.8 million in short positions, bringing their cumulative net short exposure to $21 million. This data indicates active short-term trading strategies despite BitMine’s accumulation.

Weak Demand in Ethereum ETFs

Ethereum-based exchange-traded funds (ETFs), a key driver of Ether liquidity, continue to experience weak demand. Spot Ether ETFs recorded $75.2 million in net outflows for the second consecutive day, following $1.4 billion in outflows during November. This contrast highlights the difference between long-term corporate accumulation and short-term market sentiment.

Key Highlights

-

BitMine purchased $199 million worth of Ether over two days.

-

The company’s total Ether holdings now reach $11.3 billion.

-

Smart money traders hold $21 million in cumulative short positions.

-

Ethereum ETFs continue to record net outflows.

BitMine’s strategy signals strong confidence in Ethereum’s long-term growth, even as short-term market movements and ETF outflows suggest caution among other investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.