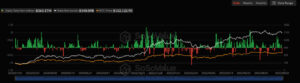

The cryptocurrency markets kicked off the new week with a troubling outlook for investors. Spot Bitcoin and Ethereum ETFs, often seen as the barometer of institutional interest, witnessed unprecedented capital outflows on Monday, September 22. The most alarming detail was that not a single ETF recorded net inflows throughout the entire day.

The Cold Numbers of September 22: The Picture Becomes Clear

Data clearly revealed a significant blow to investor confidence. By the end of the day, the figures underscored the scale of the negative sentiment across the market.

Massive Exodus from Spot Bitcoin ETFs

Bitcoin, the locomotive of the market, was hit the hardest through ETFs.

- Total Net Outflows: $363.17 million

- Net Inflowing Funds: 0 (Zero)

The fact that all 12 funds—including giants like BlackRock (IBIT) and Fidelity (FBTC)—closed the day either in the red or neutral, highlights just how widespread the selling pressure has become.

Spot Ethereum ETFs Also Took a Hit

Following Bitcoin, the market’s second-largest asset, Ethereum, could not escape the negative wave either.

- Total Net Outflows: $75.95 million

- Net Inflowing Funds: 0 (Zero)

The fact that all Ethereum ETFs also ended the day with net outflows confirms that investors are currently in full “risk-off” mode.

Possible Reasons Behind These Massive Outflows

While it’s difficult to pinpoint a single cause behind such widespread selling, several key factors stand out:

- Profit-Taking and Realization: After recent rallies, large investors and whales may have conducted bulk sales to lock in profits.

- Weakening Market Sentiment: Negative news flows or technical indicators signaling a downturn could have created a panic mood, triggering sales. The fact that there were zero inflows shows that buyers were not rushing in and were adopting a “wait-and-see” approach.

What Does This Mean for Investors?

Such large outflows generally serve as a warning signal for the market:

- Short-Term Outlook: Volatility may increase in the short term, potentially exerting downward pressure on prices.

- Long-Term Perspective: For long-term investors, these declines could present buying opportunities. Cryptocurrencies are inherently volatile, so avoiding panic selling and sticking to one’s investment strategy is crucial.

In conclusion, September 22 clearly marked a “Black Monday” for crypto ETFs. Hundreds of millions of dollars were pulled from the market, and no fresh capital flowed into any fund, reflecting cautious investor behavior in challenging market conditions. The coming days will reveal whether these outflows represent a one-time correction or the start of a longer-term downtrend.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.