Ahead of the July FOMC meeting, the spotlight is once again on interest rate policy. Rick Rieder, CIO of BlackRock, recently emphasized that the Federal Reserve should lower interest rates. According to Rieder, such a move would help ease the housing market and make inflation control easier.

His statement came just four days before the meeting. Pressure is mounting on Fed Chair Jerome Powell from both political and economic fronts. While expectations of a rate cut are weakening, Rieder’s remarks stood out.

Would a Rate Cut Benefit the Economy?

BlackRock Rieder argued that high interest rates are putting pressure on the housing market. He stated that the current levels make borrowing expensive and refinancing unattractive. This situation has led to declining homeownership rates and a contraction in the construction sector.

“If we lower interest rates, home prices could fall, and we could build more homes,” said Rieder, suggesting this could also help bring inflation down. He also noted that current rates remain effective in containing inflation.

However, strong employment data released in the U.S. have dampened hopes for a rate cut. Investors have largely scaled back their expectations for a July reduction. Still, figures like Rieder believe the Fed is enforcing an overly tight policy.

The Fed’s Decision Process and Rising Political Pressure

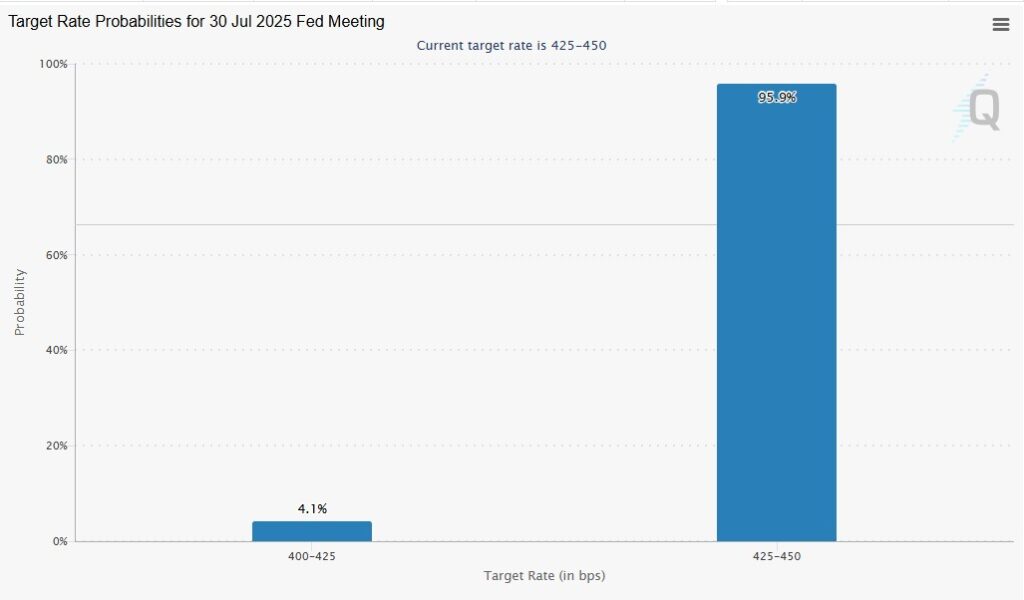

According to CME FedWatch Tool data, the probability of a rate cut at the July meeting is only 4.1%. This figure implies a potential cut to 400–425 basis points, while the chance of rates remaining unchanged stands at a dominant 95.9%.

Meanwhile, Fed Chair Jerome Powell is facing not just economic but also political pressures. U.S. President Donald Trump has intensified his criticism of Powell, blaming him for economic damage due to his refusal to lower rates.

Additionally, Powell is facing another crisis. Representative Anna Paulina Luna accused Powell of lying twice during a Senate testimony and referred the issue to the Department of Justice. This raises questions about Powell’s credibility and tenure.

Ultimately, the Fed’s decision will be shaped not only by economic indicators but also by political winds. Calls for a rate cut are growing louder, but the real answer will come at the FOMC meeting.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.