BlackRock, the world’s largest asset management firm, significantly ramped up its Bitcoin-focused investments in Q1 2025. According to its latest 13F filing with the U.S. Securities and Exchange Commission (SEC), the company injected capital not only into its own spot Bitcoin ETF but also into rival ETFs and Bitcoin mining companies.

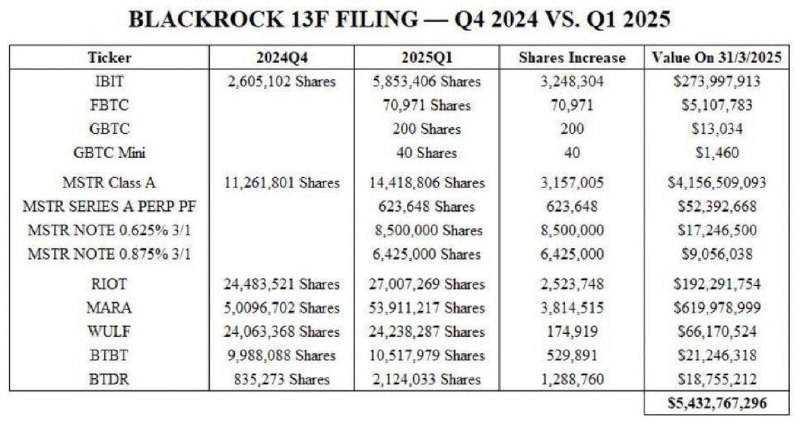

BlackRock boosted its holdings in the iShares Bitcoin Trust (IBIT) by an impressive 124.7%, acquiring over 3.2 million additional shares. This brought its total IBIT holdings to more than 5.8 million shares, valued at approximately $273.9 million.

First-Time Investments in Rival Bitcoin ETFs

In a strategic shift, BlackRock made its first-ever investments in competing Bitcoin ETFs. The firm purchased 70,971 shares of Fidelity’s FBTC, 200 shares of Grayscale’s GBTC, and 40 shares of GBTC Mini. This move reflects a more diversified and flexible approach to its Bitcoin strategy.

Strong Interest in MicroStrategy and Mining Stocks

Beyond ETFs, BlackRock expanded its portfolio to include Bitcoin-related companies. It increased its holdings in MicroStrategy (MSTR) Class A shares by 28%, reaching a total of 14.42 million shares. The firm also added over 620,000 MSTR Series A Perpetual shares, along with 15 million shares across two commercial bonds. In total, these investments amounted to more than $4.23 billion, pushing BlackRock’s overall Bitcoin-themed exposure above $5.43 billion.

Growing Stakes in Bitcoin Miners

In Q1 2025, BlackRock purchased 2.5 million shares of Riot Platforms and 3.8 million shares of MARA Holdings, making them its top mining stock holdings. The firm also allocated capital to other mining companies, including TeraWulf, Bitdeer, and BitDigital, further deepening its commitment to the sector.

Annual Growth Rate Exceeds 13,000%

BlackRock’s stake in the IBIT ETF surged by more than 13,500% year-over-year. From just 43,000 shares in early 2024, its position ballooned to over 5.8 million by 2025. This extraordinary growth indicates strong internal demand for the product.

Bitcoin Still a Tiny Slice of the Portfolio

Despite the headline-grabbing numbers, BlackRock’s Bitcoin exposure still makes up just 0.05% of its total $11 trillion assets under management. BTC, while growing in strategic relevance, remains a small portion of the overall portfolio.

Institutional Bitcoin Demand on the Rise

Spot Bitcoin ETFs and public companies now reportedly hold around 9% of the total BTC supply—with ETFs accounting for 5.5% and corporations for 3.5%. With MicroStrategy planning to expand its BTC holdings to $84 billion, the pace of institutional Bitcoin accumulation is likely to accelerate further.

These inflows not only reduce circulating supply but also reinforce long-term confidence in Bitcoin’s value proposition. At the time of writing, BTC is trading around $94,000, maintaining a tight range over the past two weeks and continuing its multi-year trend of establishing higher annual lows (excluding 2022 and 2023).

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.