BlackRock’s Strategic Moves and ETFs

As the world’s largest asset manager, BlackRock has clearly shown interest in Ethereum. Since May 9, 2025, the company has purchased 269,000 ETH, totaling $673.4 million. This acquisition was made while reducing Bitcoin ETF holdings, signaling a strategic shift toward Ethereum.

In April 2025, BlackRock executives met with the U.S. Securities and Exchange Commission (SEC) to discuss ETH staking and tokenization, laying the groundwork for institutional interest. The substantial ETH purchases following these meetings reflect the company’s confidence in Ethereum’s regulatory position and future utility. Given BlackRock’s previous role in Bitcoin’s price rally, the probability of a similar surge in Ethereum has strengthened.

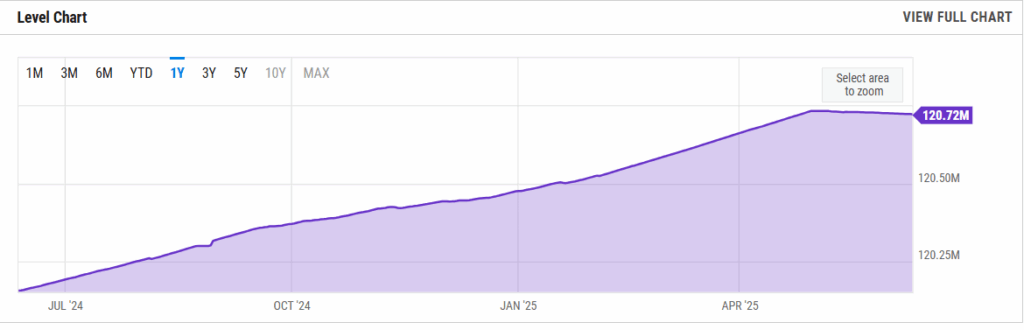

BlackRock’s iShares Ethereum

BlackRock’s iShares Ethereum Trust (ETHA) has solidified its leadership in the spot Ethereum ETF market with the latest figures. Since its inception, ETHA has surpassed $5 billion in cumulative net inflows, achieving the longest streak of uninterrupted inflows in 2025. On Wednesday, June 11, 2025 alone, it recorded $163.6 million in net inflows, significantly contributing to the total for all spot Ethereum ETFs and even surpassing Bitcoin ETF inflows.

ETHA’s assets under management (AUM) reached $4.23 billion and it holds approximately 1.55 million ETH. Its stock price surged above $21 after gaining more than 50% over the last two months, reflecting institutional investors’ strong confidence in Ethereum. This marks the highest price level since February.

ETF Store President Nate Geraci noted:

“18 straight days of inflows into spot ETH ETFs… Nearly $250 million today. And still no staking or in-kind creation/redemption. Very early.”

So far this week, BlackRock’s iShares Ethereum Trust has contributed over $250 million in inflows. Consequently, the ETHA stock price surged to $21. Over the past two months since “Trump Liberation Day,” the stock has risen over 50%, making ETHA a clear favorite among investors.

Ethereum Network Developments and Market Dynamics

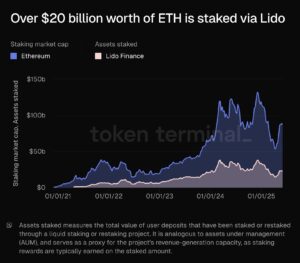

The Ethereum network has shown strong recovery recently. In May 2025, the total number of transactions reached 42 million — the highest since May 2021. Daily active addresses exceeded 440,000. Monthly transaction fee revenue rose to $42.5 million, nearly double compared to April.

Decentralized exchange (DEX) volume rose to $70.5 billion, indicating renewed activity in the ecosystem. Ethereum’s stablecoin supply reached an all-time high of $125 billion. These data highlight increased network usage and expanding economic activity, marking an end to ETH’s price stagnation.

Rising demand and the token burn mechanism are shrinking supply, potentially adding upward pressure on prices in coming quarters. On the other hand, the ETH/BTC ratio is trading around 0.03 — its lowest level in six years. Historically, such levels have coincided with trend reversals. According to analysts, the weekly RSI reaching extremely low levels also signals a strong potential for Ethereum to outperform Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.