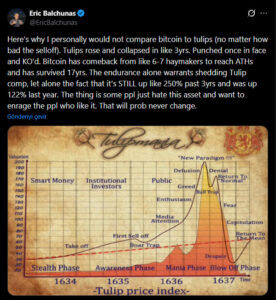

The sharp price swings in Bitcoin in recent years have led traditional finance circles to repeatedly revive the claim that “Bitcoin is just a tulip mania.” This narrative tends to surface especially during rapid rallies followed by corrections. However, Bloomberg senior ETF analyst Eric Balchunas has dismissed this comparison, stating that it is fundamentally inaccurate both historically and financially. In a social media post, Balchunas emphasized that the analogy has no real basis.

“Tulip mania lasted 3 years, Bitcoin has lasted 17 years”

According to Balchunas, the 17th-century tulip mania was a short-lived speculative frenzy with no economic foundation, lasting only a few years before collapsing and disappearing. Bitcoin, on the other hand, shows the exact opposite characteristics.

Today, Bitcoin:

- Has survived for 17 years without interruption

- Has experienced multiple severe crashes yet recovered each time

- Reaches higher highs in every cycle and proves it has become a lasting market

The analyst said:

“Bitcoin has taken 6–7 massive hits but came back every time. That resilience alone is enough to invalidate the tulip comparison.”

“Some people just hate Bitcoin”

Balchunas highlighted that Bitcoin’s long-term performance already disproves the analogy. The numbers tell the story clearly:

- Over the last three years, Bitcoin is still up more than 250%

- Last year alone, it gained 122%, outperforming many traditional assets

Despite this strong track record, the tulip narrative continues to resurface. According to Balchunas, this has little to do with rational analysis:

“Some people just hate this asset and want to irritate those who like it. That will never change.”

The 2025 correction is just a normal cooling phase

Balchunas argued that Bitcoin’s correction in 2025 is part of a normal market cycle and should not be overstated. According to him, corrections following strong rallies are healthy:

“Assets cool down from time to time. Even stocks do this. People are over-analyzing it.”

He added that Bitcoin’s high volatility is inherent to the ecosystem and does not undermine its long-term value proposition.

“Non-productive asset” criticism misses the point

The analyst also addressed the frequent criticism that Bitcoin is a “non-productive asset.” While this argument is often raised, Balchunas noted that productivity is not always the determining factor in investment value.

Assets such as:

- Gold

- Picasso paintings

- Rare collectibles

also produce no income, yet hold significant value.

Balchunas argued:

“Are we going to compare these assets to tulips as well? Bitcoin is a completely different asset class.”

Bitcoin is far stronger than the tulip mania

According to Balchunas, tulip mania was nothing more than a brief episode of extreme euphoria followed by a collapse. Bitcoin, in contrast, has become a durable asset class characterized by:

- Long-term survivability

- Cyclical price dynamics

- Growing institutional interest

- Millions of global investors

Therefore, comparing Bitcoin to tulip mania has no validity in terms of real data or market dynamics.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.